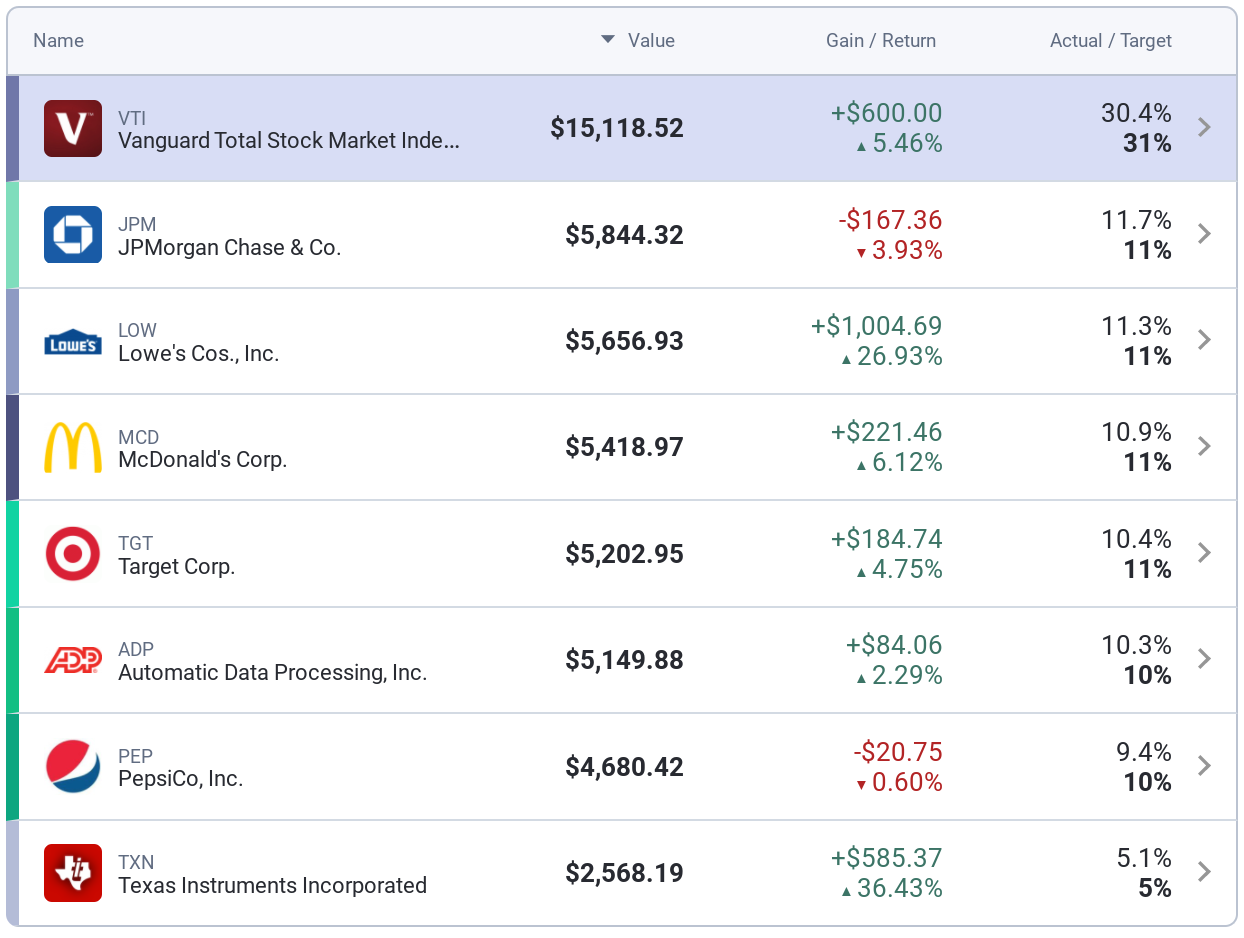

My $77,000 experiment portfolio -- June update

At the beginning of 2020, I started a new M1Finance portfolio where I picked several dividend stocks to invest in. The goal is to achieve similar returns to the SP 500 index but beat it in terms of dividends. As of the writing of this article, I’ve contributed $48,000 of my own money into this portfolio. By the end of this year, I will have contributed $77,000 ($25,000 initially and $1k contribution per week). In this article, I’ll share my M1Finance portfolio, how I’m doing against the market, my thoughts on the current stock market, and how I am doing against my FIRE schedule.

Performance Summary

-

The portfolio is up +4.76% YTD and I have unrealized gains of +$1,751.66. I’ve earned $378.12 in dividends. And when compared to VTI (total stock market, +5.46%), my portfolio is underperforming it by -0.7%.

-

This is quite the swing when compared to 2.5 months ago when my portfolio was down -18.40%...that is a +23.16% difference!

-

Overall, I’m satisfied with my portfolio performance. JPM is well on its way to a strong recovery, and I believe it has a ways to go up. ADP is another company that I believe hasn’t fully recovered yet. Once unemployment starts to improve (which it is starting to), I expect ADP to have a much stronger bounce back.

(adsbygoogle = window.adsbygoogle || []).push();

Transactions

-

If you recall from my previous portfolio update, I used to own 3M. But for various reasons, I have chosen to let it go from my portfolio. The primary reasons are that their dividend growth was disappointing (2%) and, IMO, they were unable to respond to the demands of the pandemic in a way that would have added a lot more value to shareholders.

-

After selling MMM I picked up TXN. What prompted me to look into TXN was when a reader (and friend) commented on my previous blog. Overall, it looked attractive for a long term hold. I looked at the dividend growth (a 16% dividend increase in 2019 and a 24% increase in 2018) and the dividend payout ratio (65%). It’s also a company that I believe will be able to capitalize on the opportunities ahead with their product offerings in semiconductors. Since I purchased the majority of my TXN holdings at the bottom of the market, it’s showing up as the most successful stock in my portfolio. So that should be taken with a grain of salt.

FIRE update

I used to be at 10% cash, but I am now down to around 3%.

As of 6/5/2020, I am +$332,146.58 ahead of schedule. That means if all of my other assumptions (i.e. pay stays the same, 8% annual return in the stock market) hold true for the next 2.5 years, I’ll have $322,146.58 more than the expected $4M.

(adsbygoogle = window.adsbygoogle || []).push();

Thoughts on the stock market

-

As of this week, the market has essentially recovered. Thinking back over the last 3.5 months, it's funny how things change so sharply.

-

Late Feb: record low unemployment, record-high stock market

-

Late March: the market sold off 37% from the highs, making it the fastest and sharpest crash in the history of the US stock market, the country starts to shut down, the federal government and Federal Reserve team up to pump the market with trillions of dollars.

-

April: Warren Buffett sells all of his airline holdings. "Stay-at-home" companies like ZM, SHOP, OKTA, TWLO, etc see their stock skyrocket. Big tech company stocks skyrocket. Essentially, tech was leading the way and pushed the overall index up, while banks, REITs, travel, and hotels were still suffering. Unemployment jumps from 4.4% to 14.7%.

-

Late May to early June: George Floyd's death created national outrage. Everyone started to protest. Shelter in place, curfew, social distancing...all of a sudden, none of that seemed to matter anymore. May's unemployment numbers were projected to be 19-25%, but instead it was 13.3%. We added 2.5 million jobs in sectors that COVID was impacting the most. All of that seemed to suggest that people were starting to go back to work and do not care about COVID anymore. As a result, the companies that are now seeing their stock price go up are the ones that were impacted the most by the shutdown--airlines, hotels, casinos, cruise lines, banks, and REITs. The swing in the market and change of attitude about COVID happened over a weekend quickly…

-

-

I’m still not convinced that the stock market is going to fully recover and then continue the 10-year bull run. Over 50% of the SP 500 companies have not given guidance or even cut their guidance numbers. The economy still isn’t fully opened yet. There is still no vaccine for the virus. But we do have proof that there’s a lot of pent up demand to get back to a normal life again. Once we reopen and companies are expected to provide guidance, I fully anticipate that there will be a significant number of companies that will tank. But I’ve been wrong about a hundred times during these 3.5 months, so who knows.

-

Finally, I've been buying a lot of individual stocks in my main account (not M1F). I've been sniping companies that I believe are good long term holds--Uber, Lyft, Shopify, Store Capital, Exxon Mobil, Zoom, Starbucks, Home Depot, Nike, and Okta. And for these particular companies, I’ve made an aggregated total of 23.71%.

Featured

[

](/blog/im-building-a-fire-tool-and-i-need-your-input)

I’m Building a FIRE Tool — and I Need Your Input

[

](/blog/10-ways-to-succeed-as-an-employee-part-iii-of-iii)

10 ways to succeed as an employee (Part III of III)

[

](/blog/5-reasons-why-its-hard-to-retire-early-after-reaching-financial-independence)

5 reasons why it’s hard to retire early after reaching Financial Independence

[

](/blog/road-to-1000000-portfolio-series-part-1)

dividends, investing, portfolio, fire

Road to $1,000,000 portfolio (series) - Part 1

dividends, investing, portfolio, fire

dividends, investing, portfolio, fire

[

](/blog/my-77000-experiment-portfolio-year-end-2020-update)

dividends, portfolio, fire, stocks

My $77,000 experiment portfolio -- year end 2020 update

dividends, portfolio, fire, stocks

dividends, portfolio, fire, stocks

[

](/blog/road-to-10-million-retire-by-35-and-become-a-deca-millionaire-by-50)

Road to $10 million - Retire by 35 and become a deca-millionaire by 50

[

](/blog/my-77000-experiment-portfolio-june-update)

fire, portfolio, stocks, covid19

My $77,000 experiment portfolio -- June update

fire, portfolio, stocks, covid19

fire, portfolio, stocks, covid19

[

](/blog/how-am-i-navigating-covid-19)

[

](/blog/average-net-worth-by-age)

[

](/blog/how-engineers-can-fire-in-15-years-and-have-4000000-in-net-worth)

fire, tech, engineering, silicon valley

How engineers can FIRE in 15 years and have $4,000,000 in net worth

Enjoyed this post?

Subscribe to get my latest posts on financial independence, investing, and the journey to FIRE delivered straight to your inbox.

More Posts

Trump Accounts: Free Money for Your Kids (And How to Maximize It)

5 Things I'm Focused On In 2026

Comments