Road to $10 million - Retire by 35 and become a deca-millionaire by 50

For those who have been following my story, you know that I plan to retire at 35 years old with a $4 million net worth. It has been over a year since I’ve started blogging and as I approach my FIRE number, I think I owe it to you guys on “what’s next.” Recently, someone asked if I planned to keep an aggressive, mostly-stocks portfolio or if I was going to rotate into bonds or an all-weather portfolio during retirement. The short answer is no. The nuanced answer is, maybe some real estate. In this post, I will talk about how my setup will allow me to retire comfortably, while still growing my net worth to $10 million by the time I’m 50 years old.

I will break down my Road to $10 million into 4 major components, explain how each one of them will play out over the next 15 years, and then bring it all together at the end.

First, let us take a look at the 4 major components:

-

Real estate equity (i.e. amount of money I would have if I were to sell the houses)

-

Spending

-

Stocks

-

Dividends

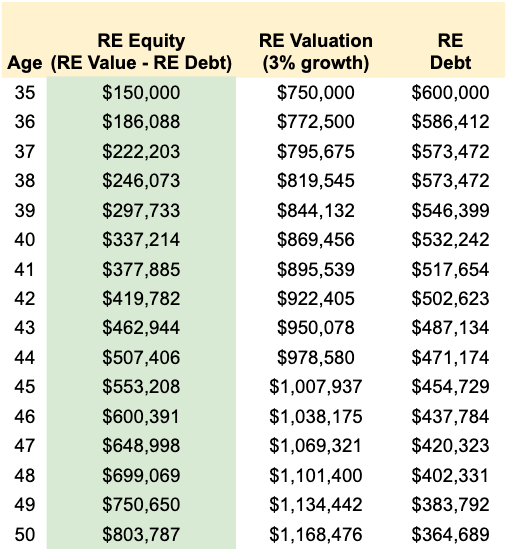

Real Estate

I am budgeting $500K for my primary house and $250K for my parents’ house. In total, I am planning to purchase two houses for a combined $750K. In reality, I doubt we would be hitting spending that much, but for planning purposes let’s see where that figure takes us.

Assumptions:

-

3.0% interest rate on a 30y fixed mortgage

-

20% down payment

-

3% annual increase in property value

At the end of 15 years, I will have $804K of my net worth tied up into the 2 houses.

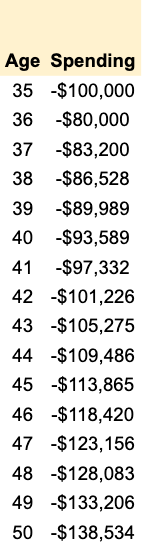

Spending

Since Texas is a LCOL (low cost of living) area, we are budgeting $80K per year in spending money. I will write a more detailed post about my future Texas budget, but here is my current budget living in the heart of Silicon Valley, where it is significantly more expensive.

(adsbygoogle = window.adsbygoogle || []).push();

Assumptions:

-

Start 1st year with $100K in cash

-

1st year will be +$20K more expensive than my planned $80K due to moving costs and house furnishing expenses.

-

2nd year will be on the normal $80K budget

-

3rd+ year we will pay ourselves an additional 3% to keep up with inflation

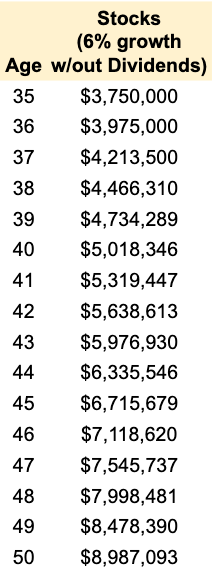

Stocks

Most of my net worth will be in stocks. I am a huge fan of index funds and dividend aristocrats, especially for people who are preparing to FIRE. The key characteristic of dividend aristocrat stocks is that their dividends increase every year. The increase generally beats inflation, so shareholders can enjoy increased buying power as they hold on to them. The aristocrats that I own have increased their dividends ~10% over the last 10 years.

As a side note, I’ve set up a M1 Finance portfolio specifically for the blog, so feel free to subscribe to follow along. I generally give updates every 1-2 months.

Assumptions:

- Stocks will appreciate at a rate of 6% annually, not accounting for reinvested dividends or inflation. This is conservative because historically it has been 10% with dividends reinvested.

At the end of 15 years, I will have $8,987,000 of my net worth tied up into stocks.

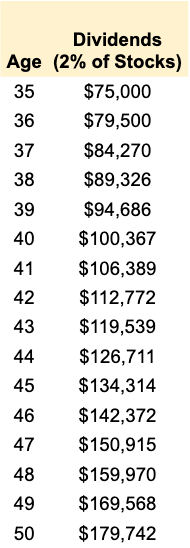

Dividends

Other than the 1st year, the yearly dividends will be enough to cover the spending column. The difference between dividend payout and spending in the 1st year will be covered with cash.

Assumptions:

-

2% dividend yield

-

First $102,750 in dividend income will be tax-free — $24,000 standard deduction and first $78,750 in long-term cap gains is taxed at 0% as of 2020.

Total Net Worth

As you can see in the chart below, even without working or finding additional income streams, my total net worth is able to grow from $4M to $10M in 15 years. In other words, my net worth will go up by $6M in 15 years...during retirement!! This is true financial freedom, where the rate of net worth gain is greater than the rate of spending.

For what it's worth, I'm not necessarily tied to this exact strategy. I may tinker in real estate. I may even spend significant capital on starting a business at some point. But this is the default plan for me to know that becoming a deca-millionaire by 50 years old is possible. What's your strategy during early retirement to continue to have your nest egg grow?

Enjoyed this post?

Subscribe to get my latest posts on financial independence, investing, and the journey to FIRE delivered straight to your inbox.

More Posts

Trump Accounts: Free Money for Your Kids (And How to Maximize It)

5 Things I'm Focused On In 2026

Comments