How engineers can FIRE in 15 years and have $4,000,000 in net worth

One of Silicon Valley’s prominent venture capitalists, Marc Andreessen, once said, “software is eating the world.” Profit margins for software are high, and at the same time, distributing software is becoming cheaper and easier. As a result, engineers are handsomely compensated in today's labor market. This is especially true in tech hubs such as Silicon Valley, Seattle, and New York City. In this article, I'll step through a hypothetical, but realistic scenario of a software engineer starting their career in Silicon Valley in 2019 at a big tech company. We will see how long it takes to reach $4,000,000.

First, let's make some assumptions about this hypothetical engineer:

-

Holds a Bachelor's degree in engineering

-

Has a job at a top tech company

-

Graduated at 22 years old

-

Married at 30 years old

-

Has first kid at 32 years old

-

Has second kid at 35 years old

-

Lives below their means throughout their working career

-

Buys a new car every 10 years

-

Spouse stays at home with kids or works enough to pay for childcare

-

The career will plateau at Google's Senior engineer level (L5). This is the average software engineer progression at a company like Google. But, based on my experience outside of Silicon Valley, still considered the top 10% of engineers in the world.

(adsbygoogle = window.adsbygoogle || []).push();

To go through this simulation with the assumptions listed above, I will break down my projections step-by-step:

Step 1. Compute the total compensation for the engineer on an average career progression.

Step 2. Compute the yearly take-home pay when taxes and retirement contributions are accounted for.

Step 3. Based on spending projections, compute the running net worth of the individual.

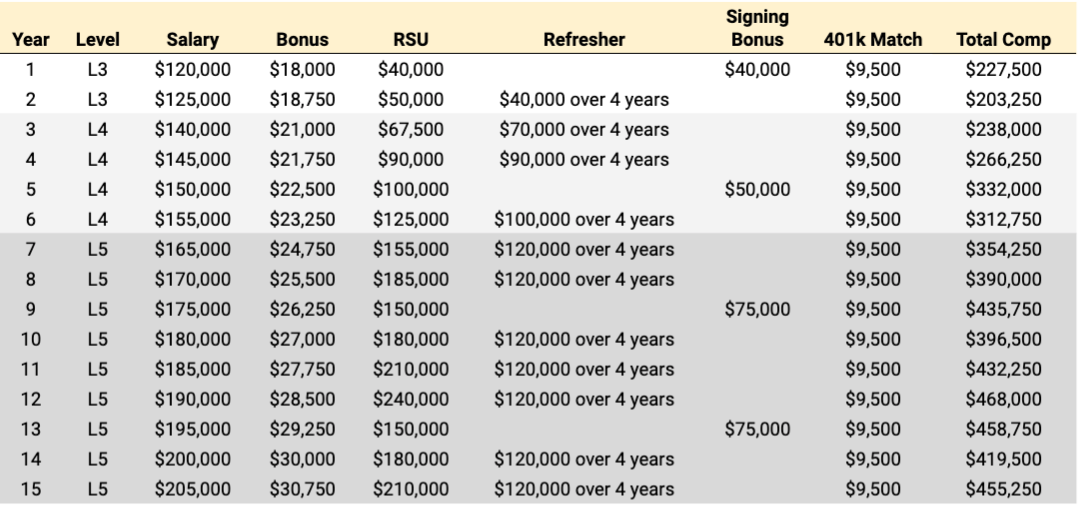

Total compensation projection

Level

L3 refers to an entry-level engineer

L4 refers to mid-level engineer

L5 refers to a senior-level engineer

Bonus

The year-end bonus is generally in the vicinity of 15%. If one performs well, it may end up being 20%, but for the purposes of this projection I’ve used 15%.

RSU

RSU stands for restricted stock units. Essentially the company will pay in the form of stocks to the employee. The employee does not need to purchase these, unlike ESPP. RSUs are usually given out over the course of 4 years. So if an engineer had an RSU grant of $400,000 (grant), the engineer will receive $100,000 (vest) in the form of stocks each year. This final amount may go up or down depending on the stock market, but the number of shares is determined at the time of the grant, not vest.

Refresher

The company will generally provide RSU refreshers yearly. Meaning they will give another RSU grant that is vested over 4 years. This is in addition to any previous RSU grants. So they can “stack.” An example is that if you were initially granted $400,000 over 4 years and received a $100,000 refresher, then you will take home $125,000 in RSUs the following year. At this rate, by the end of year 4, the initial grant is depleted and you would see a significant drop in the total compensation. For that reason, many engineers find a new job every 4 years, which is how I’ve modeled the scenario.

(adsbygoogle = window.adsbygoogle || []).push();

Signing Bonus

Signing bonuses are generally larger for more experienced folks than new grads. This is a one-time bonus that you get for joining the company.

401K match

Almost all of the big tech companies will contribute up to $9,500/year if the employee maxes out their 401K account. It is a guaranteed 50% gain.

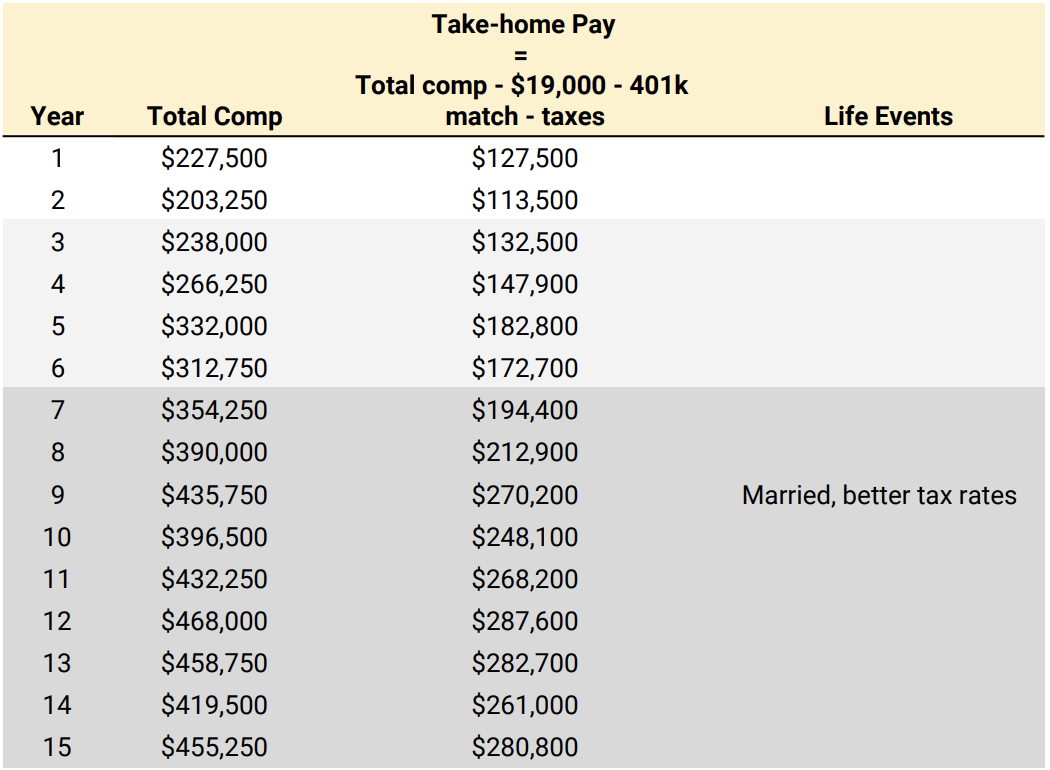

Total take-home pay

Since this engineer is getting married at 30 years old, he will file tax returns as a “single-filer” for 8 years. After that, he and his wife will file taxes jointly. This is the reason for the sudden increase in take-home pay between Year 8 and Year 9. Also, we are assuming that this engineer’s spouse does not work and will stay at home to take care of the kids. This will lead to a more conservative net worth projection because one would expect that if the spouse were working, then they would generate a net-positive impact on the take-home pay.

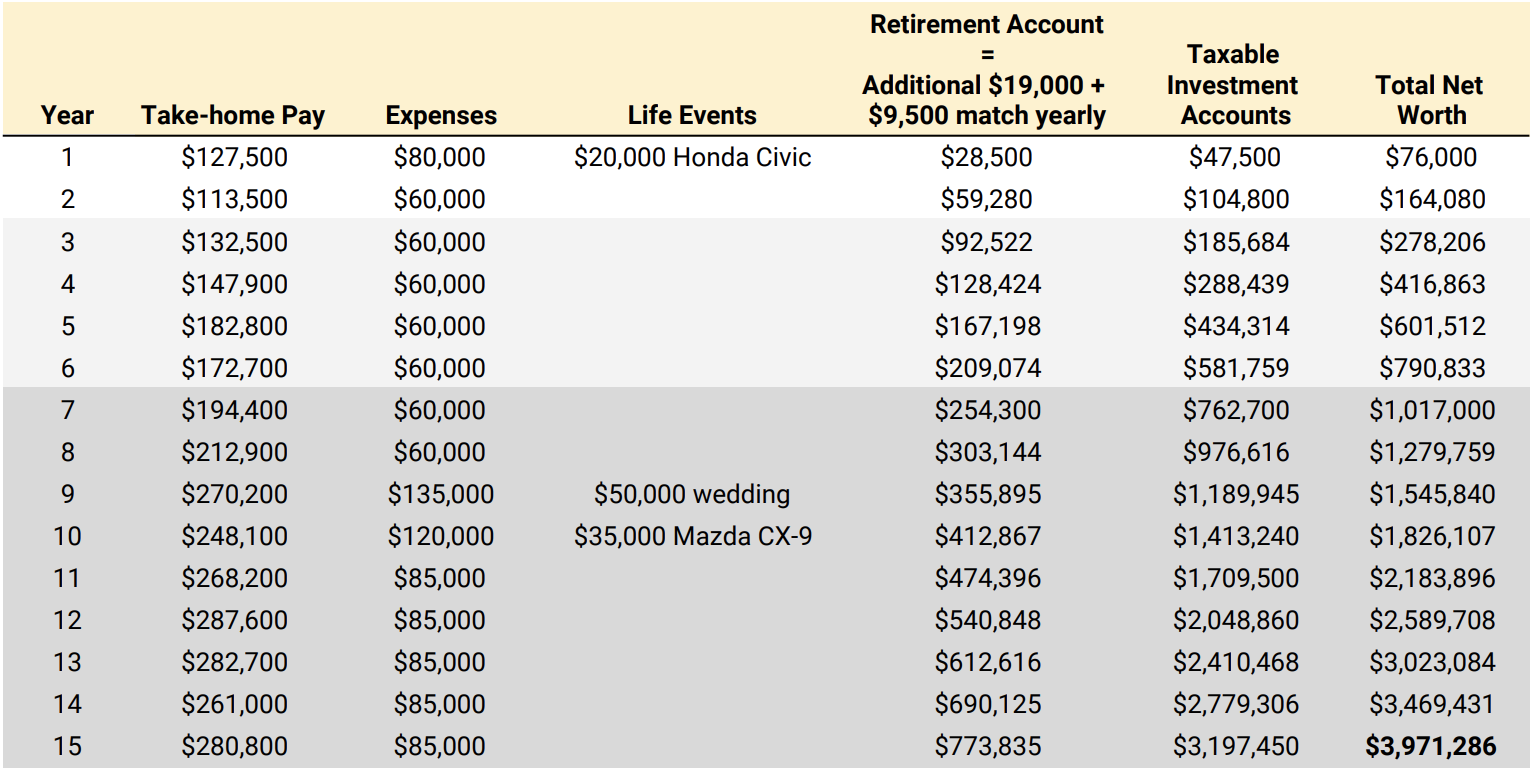

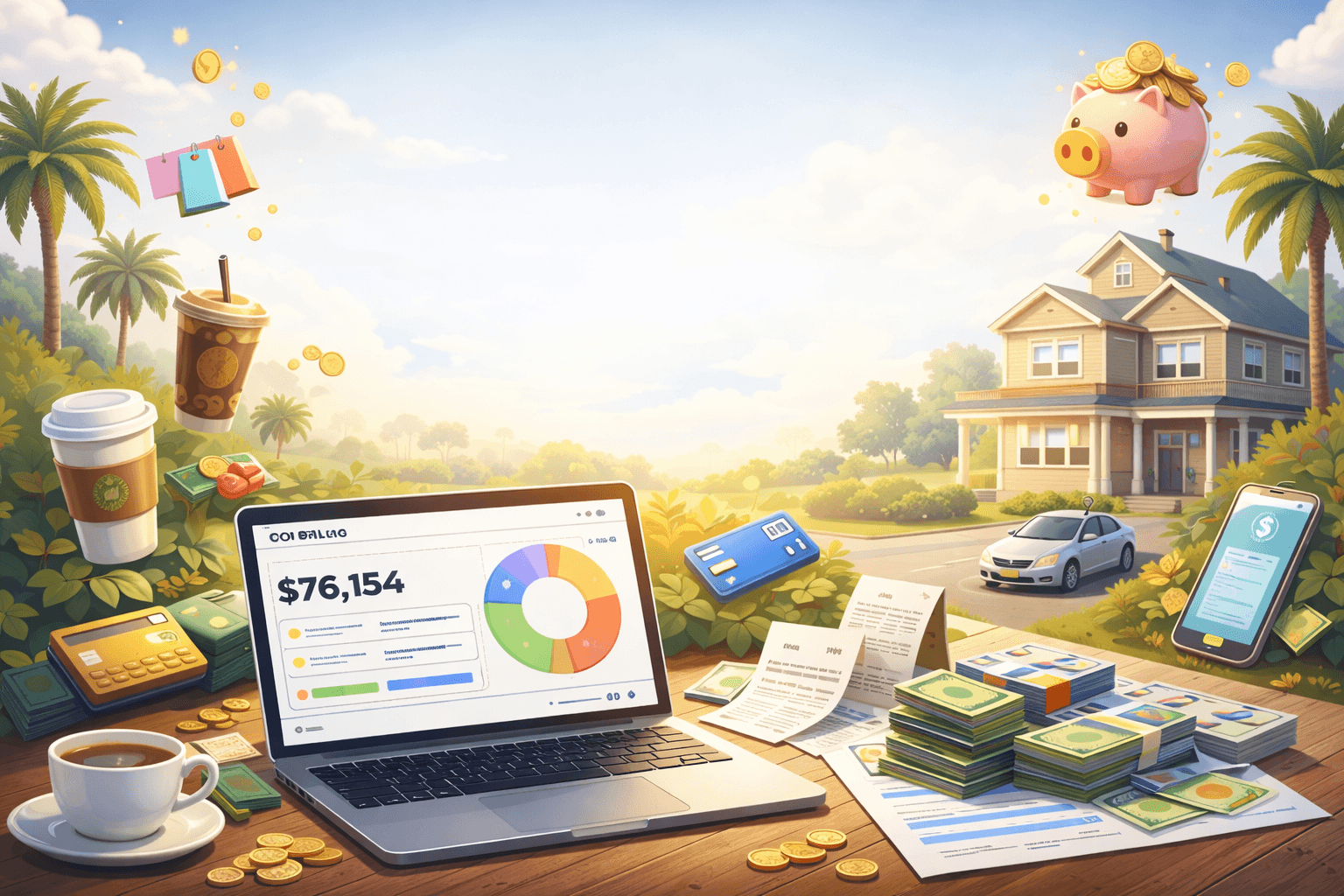

Net worth over time

The assumption is that the engineer will live off of $60,000 a year when they are single, but increase it to $85,000 a year when married (read about how I budget with childcare included). The big expenses such as cars and weddings will be cash-flowed. So at no point in time will this person be exposed to debt, which brings the risk down to a minimum. At the end of 15 years, the retirement and taxable investment accounts will grow to be over $3,971,000! The assumption here is that the stock market will average a conservative 8% during this time. This is the same rate that I use to project my finances, even though the stock market has historically returned 10% (not adjusted to inflation).

And there it is. This is how the average engineer at Google or Facebook can raise a family of 4 on a single income and still fat FIRE within 15 years. The hardest part isn't the math or even promotions, it is the planning, execution, and discipline. If you’re wondering why $4,000,000 is a good FIRE number, check this out. If you’re wondering how many years you are from fat FIRE, you can also check out my new “Tools” section which I plan to build calculators to ball-park these complex scenarios.

And boy, did I wish I was graduating during these times!

EDIT: Thanks to “E” for pointing out that I had double-counted the 401k employer matching. This ended up throwing off the final number from $4.2 million to $3.97 million.

Featured

[

](/blog/the-post-financial-independence-life-no-one-talks-about)

Dec 13, 2025

The Post-Financial Independence Life No One Talks About

Dec 13, 2025

Dec 13, 2025

[

](/blog/im-building-a-fire-tool-and-i-need-your-input)

Oct 26, 2025

I’m Building a FIRE Tool — and I Need Your Input

Oct 26, 2025

Oct 26, 2025

[

](/blog/management-vs-ic-the-fire-twist-i-didnt-expect)

Sep 7, 2025

Management vs IC: The FIRE Twist I Didn’t Expect

Sep 7, 2025

Sep 7, 2025

Jan 6, 2025

2024 Year in Review - Top 6 highlights

Jan 6, 2025

Jan 6, 2025

[

](/blog/3-things-that-make-fire-hard)

Oct 29, 2024

investing, fire, money, retirement

Oct 29, 2024

investing, fire, money, retirement

Oct 29, 2024

investing, fire, money, retirement

[

](/blog/2023-year-in-review-top-6-highlights)

Jan 1, 2024

2023 year in review - top 6 highlights

Jan 1, 2024

Jan 1, 2024

[

](/blog/5-tips-on-how-to-get-promoted-in-a-big-company)

Dec 26, 2023

5 Tips on how to get promoted in a big company

Dec 26, 2023

Dec 26, 2023

[

](/blog/is-4000000-still-a-good-fire-number)

Nov 29, 2023

Is $4,000,000 still a good FIRE number?

Nov 29, 2023

Nov 29, 2023

[

](/blog/stock-market-is-back-to-near-all-time-highs)

Jul 28, 2023

Stock market is back to near all-time highs

Jul 28, 2023

Jul 28, 2023

[

](/blog/3-ways-i-might-make-money-in-2023)

Feb 4, 2023

money, fire, stocks, real estate

3 Ways I Might make money in 2023

Feb 4, 2023

money, fire, stocks, real estate

Feb 4, 2023

Enjoyed this post?

Subscribe to get my latest posts on financial independence, investing, and the journey to FIRE delivered straight to your inbox.

More Posts

Trump Accounts: Free Money for Your Kids (And How to Maximize It)

5 Things I'm Focused On In 2026

Comments