Time to Retire? – Winter of 2022

8 years ago when I put pen to paper, I had marked the Winter of 2022 as my target date to retire. Like most multi-year estimations, I was wrong. 8 years ago I did not have a wife. I did not have 3 kids. I did not own a house. And I understood very little about personal finance. In this post, I will talk about how far off I think my estimation was and the lessons that I’ve learned as a result. Are you ready? Standby.

Estimation

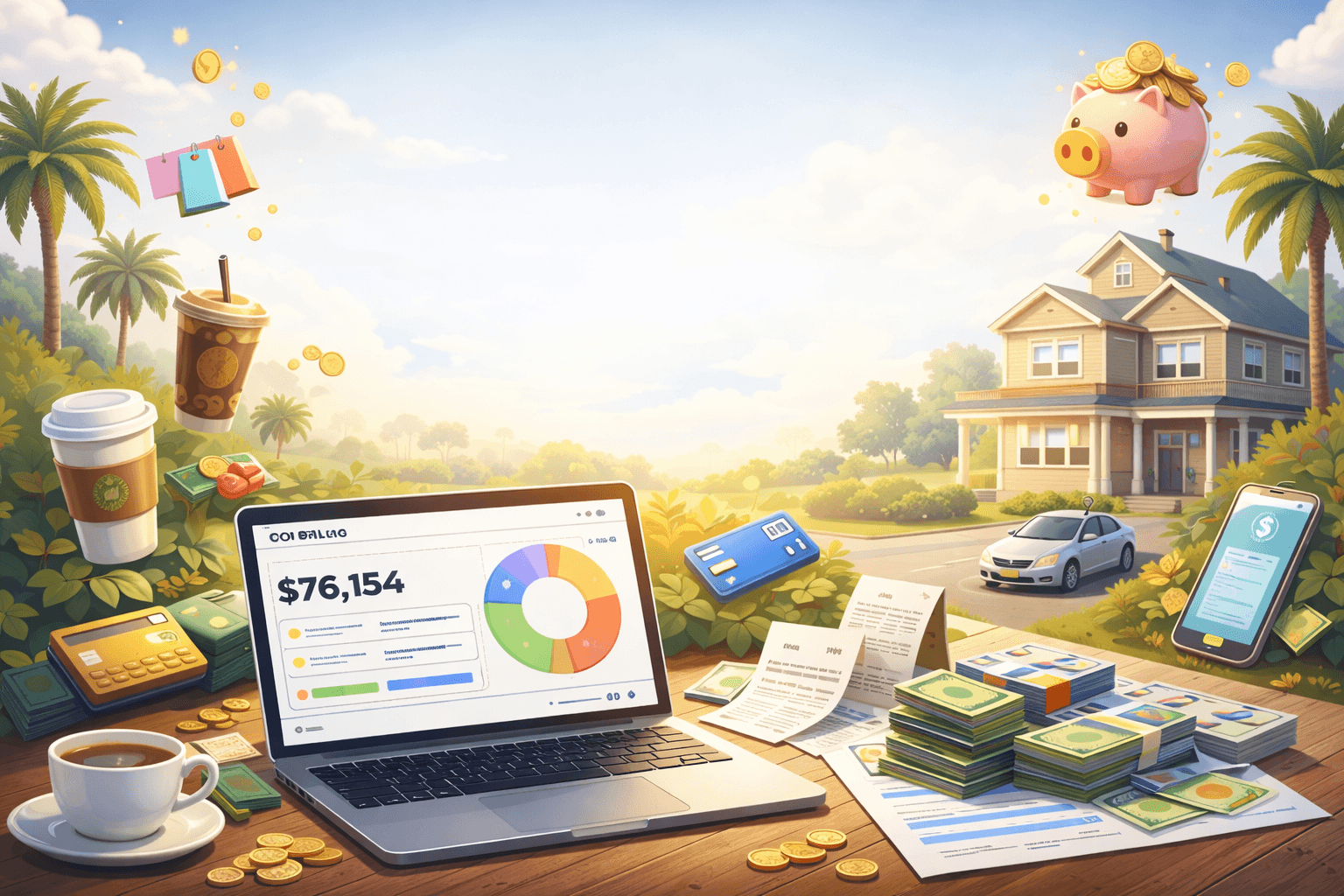

As of 12/26/2022 I am off of my retirement target by $274,510.63. It honestly feels like a rounding error in the grand scheme of things, but I am going to hold myself accountable to the strictest standards. Retirement shouldn’t be taken lightly and it’s something I believe one should do conservatively.

So what exactly is my new retirement target date? This is something that I’ve been wrestling with for the last half year. Since so much of my net worth is tied to the stock market and not my income, it’s hard to estimate. However, my best estimation is to estimate when the markets will recover and/or when one of my previous startups IPO’s, whichever is first. When any of those events happen, I’ll be way ahead of my original $4,000,000 retirement goal.

Finally, through the massive inflation we’ve seen in the last 2 years, I’ve changed my perspective on how to compute the retirement number. I will into more detail in a different article, but the general idea is to protect one’s biggest expenses from inflation.

(adsbygoogle = window.adsbygoogle || []).push();

Top 3 Lessons Learned

Early retirement planning and execution has been the longest and hardest project I’ve worked on in my life. So far, here are my top 3 lessons about planning for FIRE:

-

You want to minimize big financial changes during retirement – I recommend securing your primary residence before retiring, especially if you’ve never been a homeowner. I feel especially strong about this if you have kids. My biggest flaw in my retirement plan was I totally overlooked the retiring early (“RE”) part of FIRE. I solely focused on building my portfolio and maximizing my income (i.e. offense) that I forgot to switch gears and go into pre-early retirement (i.e. defense). For example, what I believe is the “wrong” path is to switch from a growth stock portfolio to a conservative stock portfolio after retirement. Or to purchase your primary residence after your retirement. When you are working is when you have the most resources to deal with any headwinds that may (will) occur.

-

Be flexible with the plan, inflexible with retirement conditions – 8 years ago I had no idea what it was like to be a father, husband, and son to aging parents. All I know was that I wanted everyone in my family to live a normal upper-middle class life and not have to stress about money or work in order to do so. Those conditions stay true today, however, the cost and the way to do that are different. The cost of housing, high inflation on consumer goods, and the cost to borrow have all impacted the difficulty of retiring early. It has crossed my mind to just close my eyes and retire early with what I have. There’s a good chance I will be fine doing so. But that type of thinking isn’t what I built my success on. As a result, I’ve changed my plan to not only have a net worth target but also have a set of “readiness” conditions. More on that in a future article.

-

Build a spreadsheet and have a rough estimate for your FIRE timeline – this keeps you honest and encourages you to keep controlling the controllables in your road to FIRE (e.g. keeping spending in check, earning as much as you promised yourself, investing consistently, etc.). Even though I was off, I wouldn’t have been close to where I am today if it weren’t for my spreadsheet that I look at daily. Having a system for accountability that is accurate, consistent, and non-emotional has been my best tool in achieving multi-year goals.

Final Thoughts

One of the best things about my personal road to FIRE is that I’ve been able to enjoy the long ride. I’ve been able to grow my family without hesitation about finances. I’ve been able to enjoy every single holiday season without penny-pinching. I’ve been able to invest in my hobbies with little compromise. In short, I’ve been very fortunate. While I do my yearly reflection in life, even though I fell short of my FIRE plan, there are many things for me to be grateful for. My early retirement will come, it’s just waiting on some things that are out of my control at the moment.

OK, now back to work.

(adsbygoogle = window.adsbygoogle || []).push();

Featured

[

](/blog/the-post-financial-independence-life-no-one-talks-about)

The Post-Financial Independence Life No One Talks About

I used to think hitting financial independence would flip some internal switch. That I'd wake up one day and suddenly operate differently—more sophisticated, more intentional, more free. I had a clear picture in my head of what post-FIRE life would look like.

Turns out, the reality is messier than the spreadsheet ever predicted.

[

](/blog/im-building-a-fire-tool-and-i-need-your-input)

I’m Building a FIRE Tool — and I Need Your Input

6 years ago, when I started this blog I had a goal of retiring and spending part of my free time building tools and community for the FIRE audience. Many things have changed, goals have been met, even exceeded, but my desire to continue to give back to the FIRE community is still there. I achieved FI by earning a decent salary as a high earning 9-5 employee, being financially active, not overspending, and repeating that for 15 years. Nothing special.

[

](/blog/management-vs-ic-the-fire-twist-i-didnt-expect)

Management vs IC: The FIRE Twist I Didn’t Expect

I’ve been a manager for 9 years, a Director for the last 3, running ~45 people across two orgs. By all external measures, I had “made it.” Titles, scope, social recognition, the kind of comp that makes FIRE possible years ahead of schedule.

And yet, lately, I’ve been asking myself: what if I went back to being an IC?

Not because I stalled out. Not because I couldn’t “climb higher.” But because somewhere between chasing FIRE and hitting it—I rediscovered something about myself: I actually love building things.

Let’s break this down through the lenses that always mattered to me: FIRE, money, stress, fulfillment, and recognition.

Are you ready? Standby.

Enjoyed this post?

Subscribe to get my latest posts on financial independence, investing, and the journey to FIRE delivered straight to your inbox.

More Posts

Trump Accounts: Free Money for Your Kids (And How to Maximize It)

5 Things I'm Focused On In 2026

Comments