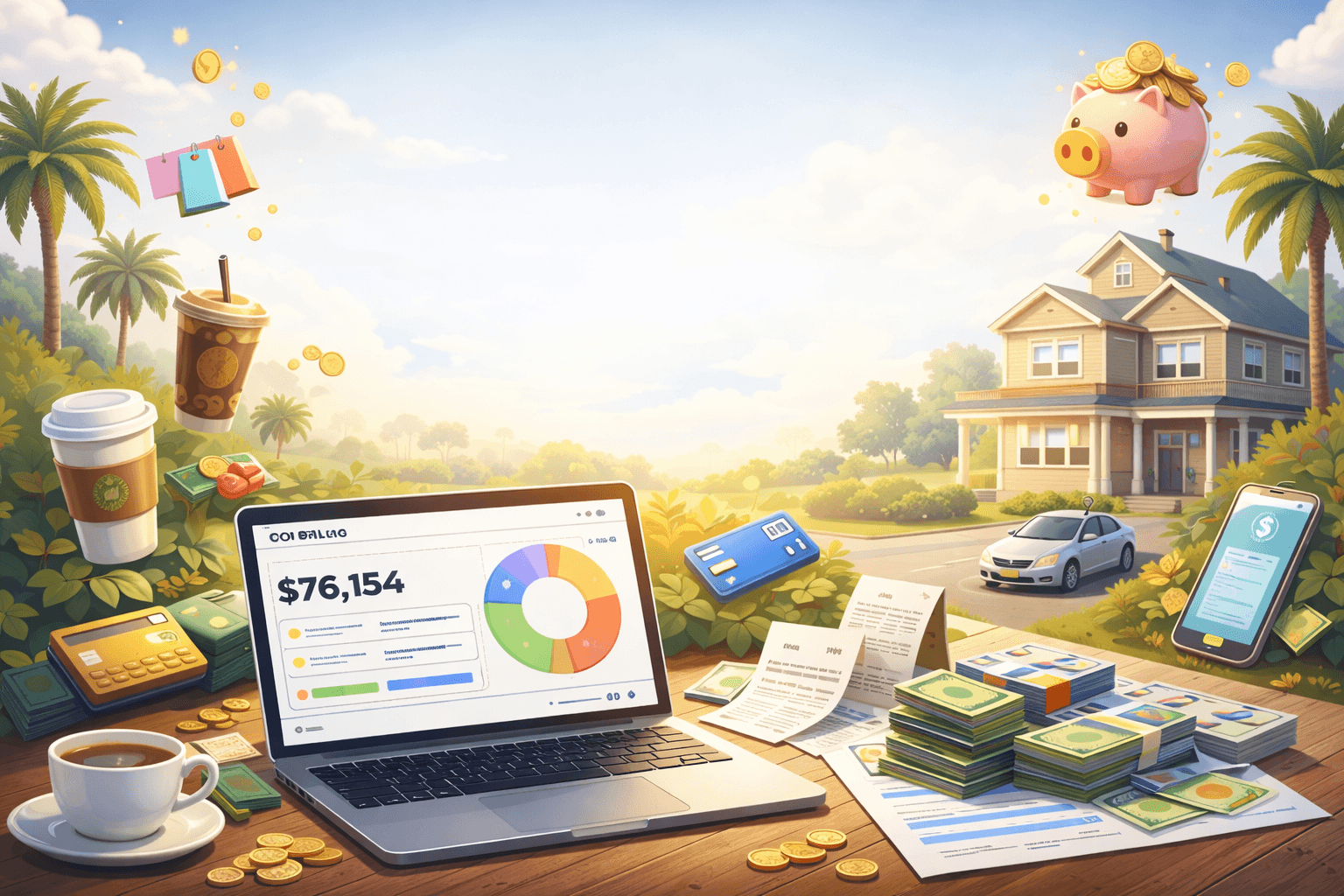

3 Ways I Might make money in 2023

For many, 2022 was a disaster year. Especially for me. I was set back by $1.84 million–yikes! Many people believe we still haven’t hit bottom yet and even fewer people believe that we will recover to 2021 levels in 2023. My prediction is that SP 500 will continue to hover around 3800-4200, mortgage rates will continue to hover around 6%, residential real estate prices will drop, but tech stocks will boom. Based on those predictions there are 3 areas I want to put my money to earn a positive return in 2023. Are you ready? Standby.

FIRE Update

Due to a good Jan 2023, I am somehow ahead of my net worth schedule by $224,173.92.

Where I’m putting my money

-

Ultra Short Income ETFs - I’ve been keeping my cash in these ultra short income ETFs that have been giving around 4.5% yield. They pay out monthly. The advantage of something like this over T-bonds or CDs is that you can essentially put unlimited capital into these ETFs and you can buy and sell them any day. T-bonds have a limit of $10,000 per year per social security number and CDs lock your money up for too long.

-

Tech Stocks are now value stocks - I strongly believe stocks such as Facebook, Microsoft, and Amazon are value stocks at the moment. I don’t think they will get back to their highs anytime soon, but these companies are loaded with cash and have made unprecedented moves to make their balance sheets look good for 2023 (e.g. layoffs, reduction of employee benefits, renewed focus on monetization). I think it won’t be until Q2 when the layoffs will pay for themselves. But I’m excited to see how the tech sector may rally. With that said I won’t be a net positive buyer of tech stocks this year. My portfolio is already tech-heavy and I’ve held on to dear life for the past 15 months. I will be rebalancing though.

-

Real Estate (stretch goal) - at a high level, the number of homes listed for sale has risen by 55% in 2022 and the average home is taking ~13 days longer to sell. Based on those 2 metrics one would expect median home prices to decrease. It has actually been the opposite. The median list price has *increased* by 8%. The only explanation I can come up with is that sellers do not feel like they have to sell, yet. If home prices in Texas do end up going south, I’ll be certain to be on a buying spree. As it is right now, the prices are still too high. Coupled with 2.4% property taxes, it’s almost impossible to make the numbers worth it.

(adsbygoogle = window.adsbygoogle || []).push();

What am I looking at

Aside from looking at residential real estate properties under $400k in my area and certain tech stocks, I’m particularly looking at the Federal Reserve’s actions. If they continue to raise rates, I don’t think a tech stock rally will happen and I may go hide out in the Ultra Short Income ETFs for even longer. If they pause (likely) or even cut rates (not likely), I’ll be certain to aggressively buy more stocks.

Featured

[

](/blog/the-post-financial-independence-life-no-one-talks-about)

The Post-Financial Independence Life No One Talks About

[

](/blog/im-building-a-fire-tool-and-i-need-your-input)

I’m Building a FIRE Tool — and I Need Your Input

[

](/blog/management-vs-ic-the-fire-twist-i-didnt-expect)

Enjoyed this post?

Subscribe to get my latest posts on financial independence, investing, and the journey to FIRE delivered straight to your inbox.

More Posts

Trump Accounts: Free Money for Your Kids (And How to Maximize It)

5 Things I'm Focused On In 2026

Comments