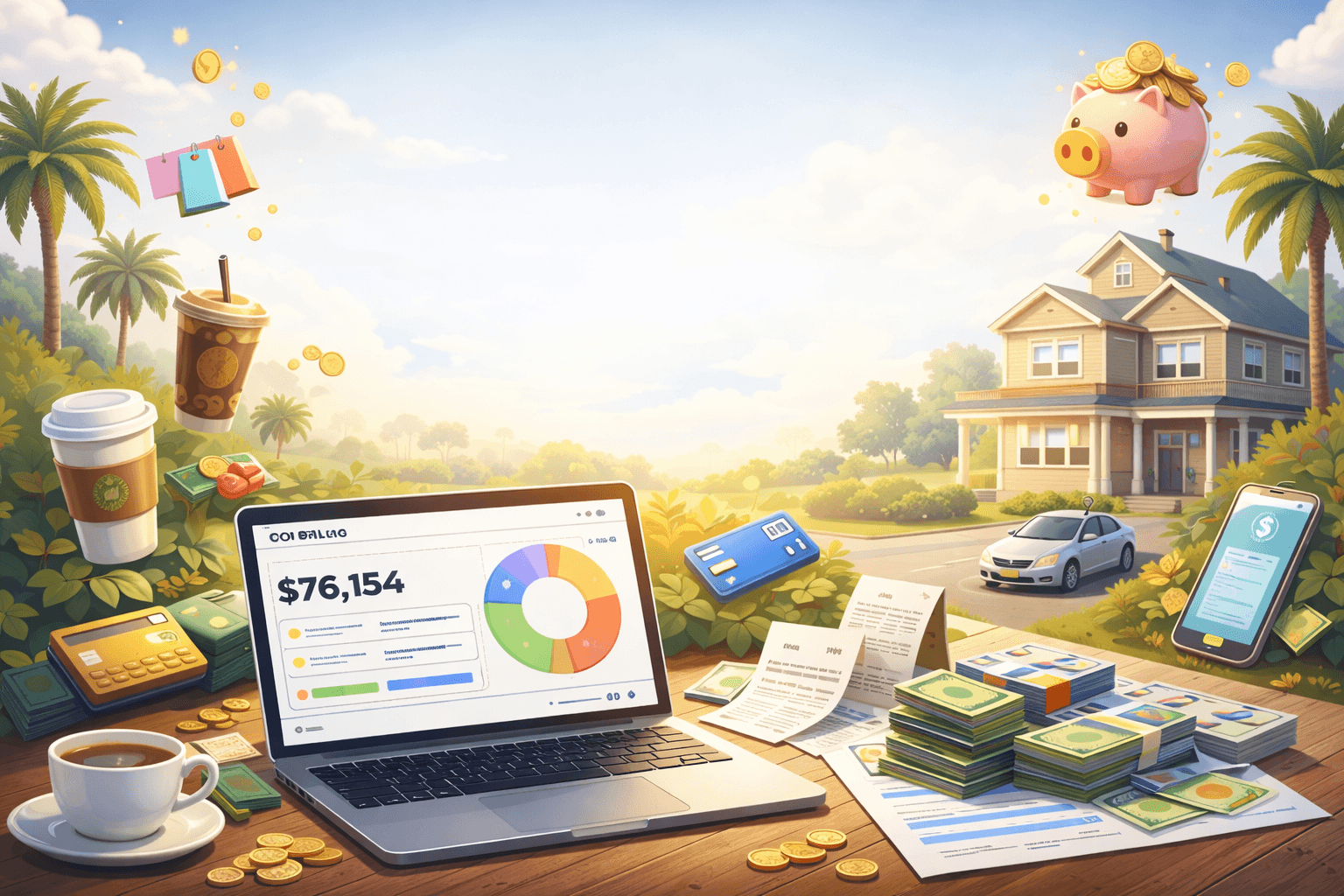

My $77,000 experiment portfolio -- year end 2020 update

Happy new year! A year ago, I started a new M1Finance portfolio where I picked several dividend stocks to invest in. The goal was to achieve similar returns to the SP 500 index but beat it in terms of dividends. As of the writing of this article, I’ve contributed $77,000 of my own money into this portfolio ($25,000 initially and $1k contribution per week). In this article, I’ll share the end-of-the-year results, how I’m doing against the market and my thoughts on the dividend aristocrat experiment. Finally, I will be sharing an update on what I plan to do during 2021--stay tuned!

M1Finance Performance Summary

-

I put $77,000 into the portfolio and it is now worth $94,453.80--that is a $15,304.72 gain!

-

My portfolio is up +32.71% YTD. When compared to VTI (total stock market, +33.75%), my portfolio is underperforming by -1.04%.

-

My portfolio yielded $1,239.87 in dividends

(adsbygoogle = window.adsbygoogle || []).push();

(adsbygoogle = window.adsbygoogle || []).push();

Thoughts on 2020 dividend aristocrat experiment

What an incredible year. At the beginning of 2020, we were already at an all-time high in the stock market. After a free-fall in Feb and March, it still reached new highs. Even though my portfolio underperformed the market by 1.04% for the year, I am more convicted on having dividend aristocrats as a part of my portfolio. During the COVID crash, I was beating the market by as much as 5%. Although it was short-lived, it shows that the dividend aristocrats are resilient during bad times.

2020 was a good test for such a portfolio. It tested panic selling, tested a recovery, and also tested (err...testing) if companies are going to continue to increase their dividends. There couldn’t have been more happening in a single year than what we saw in 2020.

What’s new for 2021

So what’s next for my $77,000 experiment portfolio? As I approach early retirement, I want to shift more of my assets into dividend aristocrats. I will expand the list of companies I invest in by taking another look at dividend aristocrats (25+ years of increasing dividends) and dividends challengers (10+ years of increasing dividends). Additionally, I may be tinkering with aggressive growth ETFs such as ARKK because…why not, I'm still young.

In order to properly fund the new list of companies, starting the first week of 2021, I will be contributing $2,000 every week instead of $1,000. That means that I will be contributing $104,000 over the next 52 weeks! So subscribe to follow along!

Email Address

Subscribe

Thank you for subscribing!

FIRE update

As of 1/3/2021, I am +$791,335.42 ahead of schedule!

Featured

[

](/blog/the-post-financial-independence-life-no-one-talks-about)

The Post-Financial Independence Life No One Talks About

[

](/blog/im-building-a-fire-tool-and-i-need-your-input)

I’m Building a FIRE Tool — and I Need Your Input

[

](/blog/management-vs-ic-the-fire-twist-i-didnt-expect)

Management vs IC: The FIRE Twist I Didn’t Expect

2024 Year in Review - Top 6 highlights

[

](/blog/3-things-that-make-fire-hard)

investing, fire, money, retirement

investing, fire, money, retirement

investing, fire, money, retirement

[

](/blog/2023-year-in-review-top-6-highlights)

2023 year in review - top 6 highlights

[

](/blog/5-tips-on-how-to-get-promoted-in-a-big-company)

5 Tips on how to get promoted in a big company

[

](/blog/is-4000000-still-a-good-fire-number)

Is $4,000,000 still a good FIRE number?

[

](/blog/stock-market-is-back-to-near-all-time-highs)

Stock market is back to near all-time highs

[

](/blog/3-ways-i-might-make-money-in-2023)

money, fire, stocks, real estate

3 Ways I Might make money in 2023

money, fire, stocks, real estate

Enjoyed this post?

Subscribe to get my latest posts on financial independence, investing, and the journey to FIRE delivered straight to your inbox.

More Posts

Trump Accounts: Free Money for Your Kids (And How to Maximize It)

5 Things I'm Focused On In 2026

Comments