How much did I spend in 2025???

Published: December 21, 2025 Author: Road to FIRE

It's that time of the year again! The annual spending review. There's something satisfying about seeing where all the money went—even when some of it makes me cringe. This year is a little different though: I finally got to use my own tool, SpendSense, to do the heavy lifting. More on that later.

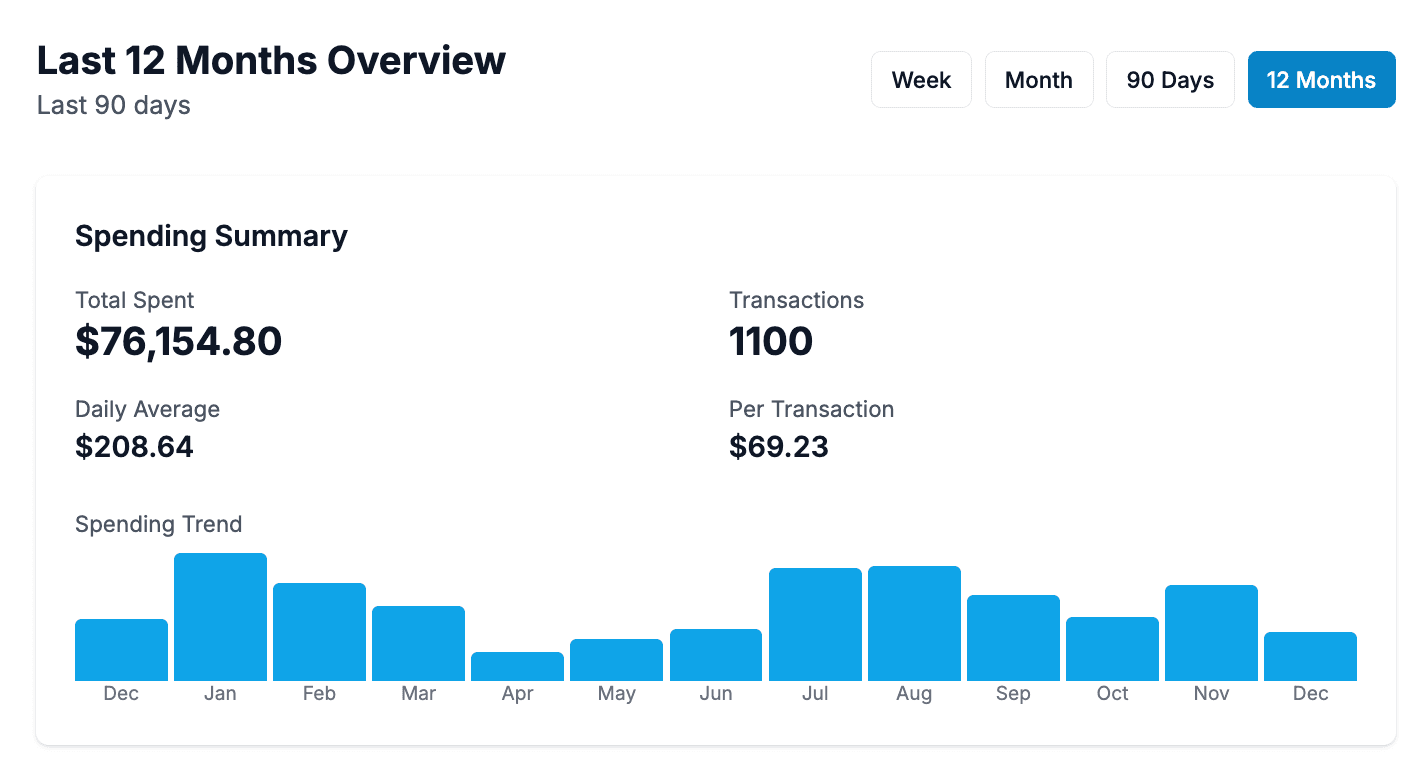

I spent $76,154.80 in 2025. For context, my total spending in 2020 was $97K—but that included everything. In reality, I'm probably spending more now when you factor in the mortgage and everything else. But we also went from 2 kids to 4, and from a 1,000 sqft townhome to a 4,000 sqft house. Life looks very different. The fact that discretionary spending hasn't ballooned feels like a win.

Important caveat: This is credit card spending only. It doesn't include things like mortgage, HOA payments, property taxes, or other bills paid directly from checking. So the real number is higher—but this captures the discretionary and day-to-day stuff, which is what I actually want to understand.

Distribution of Transactions

- 1,122 total transactions — about 3 per day, $208.64 daily average

- 78% of transactions were under $100, but only accounted for 37% of total spending

- 11 transactions over $500 made up nearly 8% of the total

The big purchases always hit different.

Fun Facts

-

Boba tea & desserts: $931 — In 2020, I called out our $473 boba habit. This year we nearly doubled it. I tell myself it's my wife's habit, but honestly, I drink most of it :). Unlike 2020 where Tan Cha was the spot, we're now spreading the love across Happy Lemon, TP Tea, and various mom and pop shops around Dallas. The kids aren't into boba yet, but they love Pinkberry which accounted for 20% of our boba tea and dessert spend.

-

Starbucks: $414 across 37 transactions — Up from $253 in 2020. We both drink it now, and we figured out a hack: mix it ourselves so it tastes more like Vietnamese coffee.

-

McDonald's: $184 across 21 trips — We've gone from Whole Foods organic fruits to Happy Meals. Funny how fast the diet goes out the window when convenience is on the line. At least kids meals are cheap.

-

Uber Eats + Instacart: $1,106 combined — This wasn't even a category in 2020. My company gives Uber Eats stipends, so we're making the most of it. Really useful on lazy days.

-

Urban Air + Malibu Jack's: $747 combined — The kids are getting more expensive to entertain. But I'll be honest—I'm enjoying these trips just as much as they are.

-

Khun Nye Tha: $457 — We discovered this Thai spot in August and it immediately became our go-to. I get the pad thai every time. Highly recommend if you're in the DFW area.

-

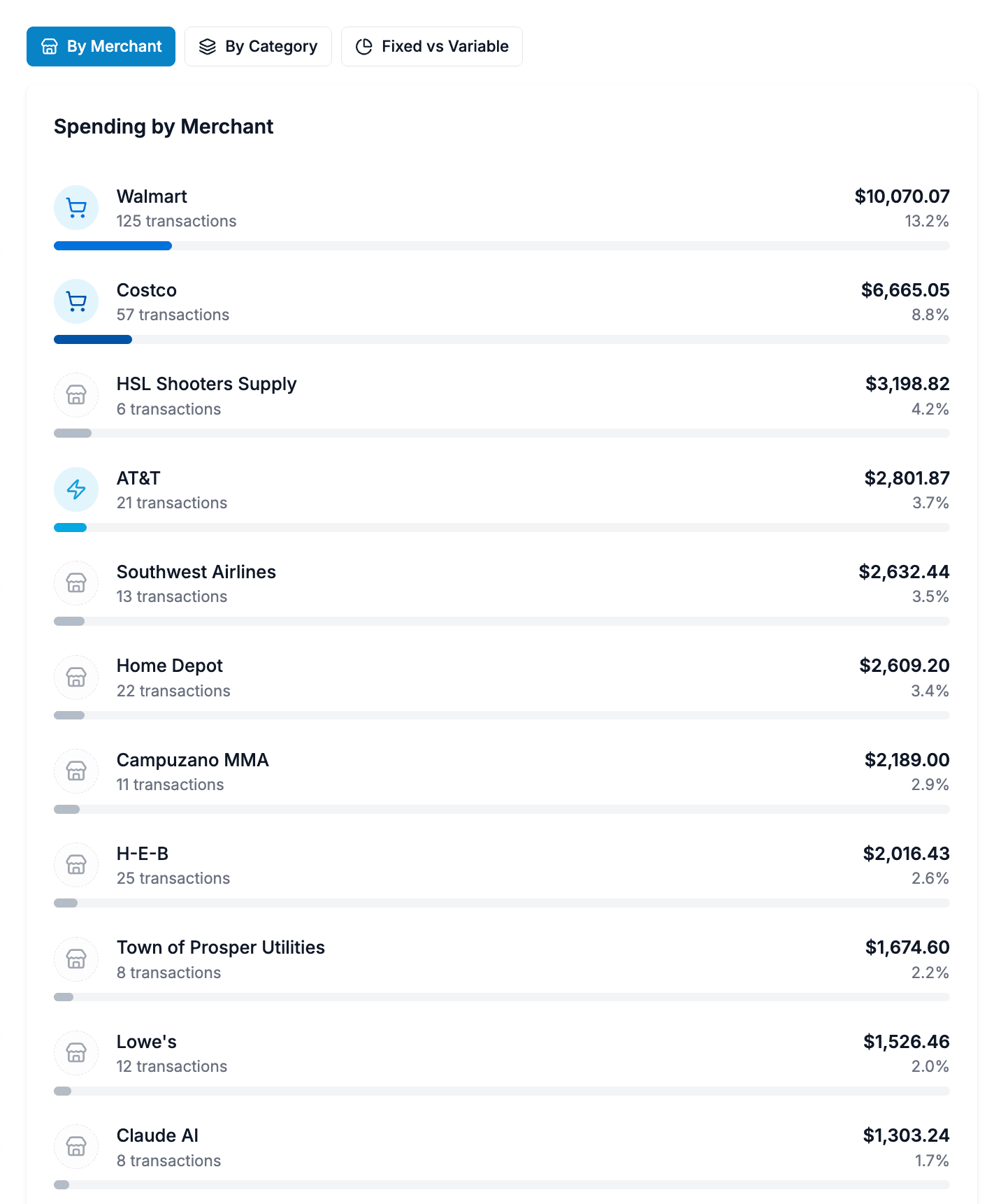

Transportation: $3,763 across 83 purchases — All gas and tollways. In Texas, those tollways add up!

Where I Did Poorly

HSL Shooters Supply ($3,199) — If you've been reading for a while, you know I picked up a new hobby back in 2020 during all the chaos. I said then that it might need budgeting for in the future. Well, here we are. This is just the cost of ammo—doesn't include gear, range fees, training, or competition entry fees. You read that right, I compete. And at a pretty high level. For those wondering, I'm a Grandmaster in USPSA. This is a hobby I don't see going away anytime soon, I've already internalized that it's gonna be a non-discretionary item :).

AT&T ($2,802) — Phone plus internet. The phone bill runs about $190/mo, which covers my family plus my parents on the same plan. Honestly, I have no idea if that's good or not. Am I overpaying? Let me know in the comments if you've got a better deal.

Where I Did Well

Food spending — $15,344 for a family of 5 (just became 6 with baby #4!) is solid. That's groceries, restaurants, everything. We cook at home most nights, and it shows.

Travel — $3,158 total across 15 transactions. We took one family trip, flew the grandparents out multiple times, and didn't go overboard. Money well spent on time together.

Daycare — This isn't captured in credit card spend, but it's worth mentioning. In California, we were paying $2,100/month per kid—and I've heard that same daycare is now $3,000. In Texas, we're paying about $400 per kid per month. That's a massive difference, and arguably for better care. Our kids are learning to be more polite and independent here. Hard to put a price on that.

FIRE Update

Since you're here, might as well share where things stand. I'm currently $2,554,918 ahead of my original FIRE schedule. Last year at this time, I was $1,915,984 ahead. That means the gap widened by about $600,000 this year alone.

The math continues to math. Once you hit a certain threshold, compound growth does most of the work. I'm still employed, still investing, but the portfolio is now the main engine.

One More Thing: SpendSense Closed Beta

I've been building SpendSense for the FIRE community—a tool to track spending, generate insights, and actually understand where your money goes without the manual spreadsheet grind. The screenshots in this post? That's all from SpendSense.

I'm opening up a closed beta for readers who want early access. If you're interested:

Join the SpendSense Waitlist

Get early access to the FIRE community's spending tracker.

I'm looking for people who want to actively use it and give feedback. No promises on timeline, but I'm building this for us—people who actually care about the numbers.

Conclusion

$76K in credit card spending in Texas. Looking back, I'm grateful that things are roughly in check despite vastly different life circumstances than five years ago. More kids, bigger house, higher net worth—but no glaring lifestyle creep. We spend more in some areas, less in others, and it seems to net out to a wash. Probably.

The best part of this year's review? I didn't have to manually categorize 1,122 transactions. SpendSense did it for me, generated the insights, and I just had to sit here and write about it. That's the dream.

Here's to another year of making smart decisions, staying the course, and enjoying the journey.

Enjoyed this post?

Subscribe to get my latest posts on financial independence, investing, and the journey to FIRE delivered straight to your inbox.

More Posts

Trump Accounts: Free Money for Your Kids (And How to Maximize It)

Comments