5 reasons why it’s hard to retire early after reaching Financial Independence

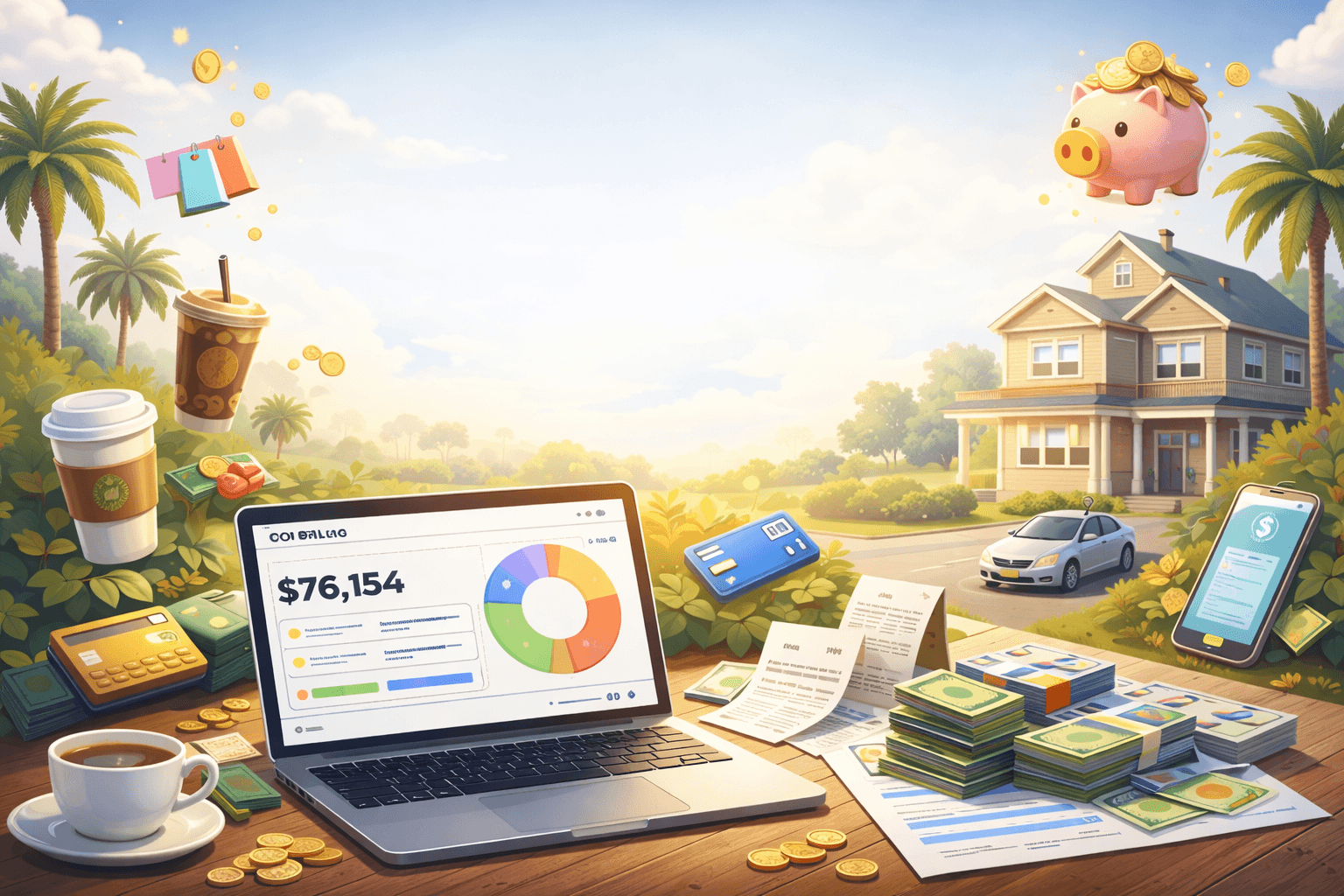

I thought that when I hit my $4,000,000 FI number, I would immediately hand in my resignation letter and pack my bags the next day. After all, I’ll be financially independent. I’ll have enough f-you money to do whatever I want. Why would I care what my employer has to say? Well, I reached my FIRE number in the middle of 2021 and I’m still working 9 months later. Over the last year, as I quickly approached my FIRE number I learned a great deal on what it takes to retire early. I’ve been overly focused on achieving FI and it came so fast, that I was left ill-prepared to RE. In this post, I’ll outline 5 of the difficulties that I’m currently going through and why I haven’t been able to throw in that resignation letter…yet. Are you ready? Standby.

1. Homes prices have skyrocketed

I originally planned to spend $750k on 2 homes in the Dallas area. $500k for my house and $250k for my parents. Unfortunately, home prices have increased in the last 2 years to the point where what used to cost $500-$600k now costs $1M+. We currently have a new home being constructed that costs roughly $1M. This gross underestimation of my home expense has given me a lot of pause.

2. Wife is unexpectedly, but happily pregnant with baby #3

During the tail end of my paternity leave for baby #2, we found out that we have baby #3 on the way. Totally unplanned. But I’m happy that our family is growing and we’ll soon have 3 boys creating havoc around the house. My current employer gives a very generous 4-month paternity leave. So my current chess board is: work for 4 months and get 4 months off OR quit now and start retirement life with a baby coming in 4 months. After you read bullet point #5 this point will sink in further. But essentially, I’ll get paid double on an hourly basis–because I’m working half the time (4 months) and getting paid for the full duration (8 months). It’s really hard to beat this deal.

(adsbygoogle = window.adsbygoogle || []).push();

3. Home construction delays force us to be in a waiting pattern

The new home construction business has been very chaotic since the beginning of the pandemic. Supplies are hard to find and backed up for months, labor is hard to find and getting more expensive, and my city’s home inspectors are busy because there’s so much new construction. As an example, we have been waiting for 2 months to get the framing of my home inspected by the city. But in order to start that, we needed all windows to be installed. We have been waiting on a single window for weeks. And when we finally got it, it was the wrong size! Bummer. The new ETA for the home is mid-April.

4. Inflation and imminent recession is top of mind

It is a scary thought to think that inflation and a recession combined will eat away at my net worth. I feel pretty confident that I can withstand it though. However, these are the least ideal conditions to have when considering calling it quits. I’ve cashed out a decent amount in preparation for the home and another downturn, but one can never be over-prepared for what I think will come.

5. I’m at the height of my career and making 7-figures

For the first time, I made 7-figures from my daytime job in 2021. It is unreal. I’ve truly lived the American Dream. I was the kid who got free and reduced lunch growing up. I lived in the ghettos the first 10 years of my life. My first restaurant experience was at McDonald’s when I was 9 years old. And the first time I got on an airplane was when I was going to a job interview at 19 years old. It’s been difficult to think that I would give up what I’ve been able to build up to, considering where I started. But…freedom! I constantly need to remind myself that there are a lot of other things waiting for me to do.

Final Word

With all of these conditions, I am still determined to pull the plug in late 2022. I have a couple of positives working for me. I currently have a 7-figure tailwind because one of my previous startups raised a sizable round of funding, making the company now worth over $2.6B. This pool of money was never accounted for in my FIRE plan and it’s turning out to be substantial. Additionally, I have another 8+ months of working to continue to accumulate stocks and capitalize on any market downturn.

Finally, I’m finding that through my free FIRE coaching sessions, my desire to expand Road to FIRE is growing. There are so many tools and services that I want to provide that I cannot wait to get started!

(adsbygoogle = window.adsbygoogle || []).push();

Featured

[

](/blog/the-post-financial-independence-life-no-one-talks-about)

Dec 13, 2025

The Post-Financial Independence Life No One Talks About

Dec 13, 2025

I used to think hitting financial independence would flip some internal switch. That I'd wake up one day and suddenly operate differently—more sophisticated, more intentional, more free. I had a clear picture in my head of what post-FIRE life would look like.

Turns out, the reality is messier than the spreadsheet ever predicted.

Dec 13, 2025

[

](/blog/im-building-a-fire-tool-and-i-need-your-input)

Oct 26, 2025

I’m Building a FIRE Tool — and I Need Your Input

Oct 26, 2025

6 years ago, when I started this blog I had a goal of retiring and spending part of my free time building tools and community for the FIRE audience. Many things have changed, goals have been met, even exceeded, but my desire to continue to give back to the FIRE community is still there. I achieved FI by earning a decent salary as a high earning 9-5 employee, being financially active, not overspending, and repeating that for 15 years. Nothing special.

Oct 26, 2025

[

](/blog/management-vs-ic-the-fire-twist-i-didnt-expect)

Sep 7, 2025

Management vs IC: The FIRE Twist I Didn’t Expect

Sep 7, 2025

I’ve been a manager for 9 years, a Director for the last 3, running ~45 people across two orgs. By all external measures, I had “made it.” Titles, scope, social recognition, the kind of comp that makes FIRE possible years ahead of schedule.

And yet, lately, I’ve been asking myself: what if I went back to being an IC?

Not because I stalled out. Not because I couldn’t “climb higher.” But because somewhere between chasing FIRE and hitting it—I rediscovered something about myself: I actually love building things.

Let’s break this down through the lenses that always mattered to me: FIRE, money, stress, fulfillment, and recognition.

Are you ready? Standby.

Sep 7, 2025

Jan 6, 2025

2024 Year in Review - Top 6 highlights

Jan 6, 2025

Happy New Year! 2024 was another fantastic year for investors. Even though I barely moved any money around, I had my 2nd highest return ever. 2024 was also a year where I felt comfortable enough to move decent chunks of money into non-traditional investments. In this post, I will review some of my year's highlights. Are you ready? Standby.

Jan 6, 2025

[

](/blog/3-things-that-make-fire-hard)

Oct 29, 2024

investing, fire, money, retirement

Oct 29, 2024

investing, fire, money, retirement

These days I hardly ever think about money. It is quite the contrast from before when I’d check in on the stock market every day, do back-of-the-napkin math on investment opportunities, and follow the Federal Reserve for macroeconomic movements like a hawk. But after some reflection, I must admit that I am a little stuck in my progression towards FIRE. In this blog post, I want to share the 3 challenges all FIRE people go through and how one of them currently has me in a pickle. Are you ready? Standby. (FIRE update at the end)

Oct 29, 2024

investing, fire, money, retirement

[

](/blog/2023-year-in-review-top-6-highlights)

Jan 1, 2024

2023 year in review - top 6 highlights

Jan 1, 2024

2023 was a fantastic year for people who held on to their stocks–up ~25% for the year. Despite interest rates, the cost of housing, and the cost of cars still being high, it was an overall good year for investors. As long as you were in crypto, bonds, or stocks it was pretty hard to have lost money. In this post, I will go over some of the highlights of my year. Are you ready? Standby.

Jan 1, 2024

[

](/blog/5-tips-on-how-to-get-promoted-in-a-big-company)

Dec 26, 2023

5 Tips on how to get promoted in a big company

Dec 26, 2023

Over the last 8 years as a manager of engineers and having been in hundreds of conversations about promotion candidates, I have learned that there is a huge disconnect between employee expectations and reality. Specifically, there is a gap in understanding of the employee’s role in the promotion process vs their manager, of the employee’s impact vs how hard they work, and of the employee’s behaviors vs how they are perceived by others. If you are frustrated about your lack of promotion or just want to learn how the sausage is made, this post is for you. Are you ready? Standby.

Dec 26, 2023

[

](/blog/is-4000000-still-a-good-fire-number)

Nov 29, 2023

Is $4,000,000 still a good FIRE number?

Nov 29, 2023

4 years ago when I started MyRoadToFire I got a good amount of readers because the FIRE community was defining fatFIRE as having a net worth of $2,500,000 but I, and many of you, believed that to be too low. In 2019, I strongly believed that having $4 million would comfortably allow a family to FIRE. Fast forward to the end of 2023, I strongly believe that having only $4 million would be extremely risky for that same family to FIRE. So was I wrong? As one of my most annoying managers used to say “yes and no.”

Nov 29, 2023

[

](/blog/stock-market-is-back-to-near-all-time-highs)

Jul 28, 2023

Stock market is back to near all-time highs

Jul 28, 2023

It’s been 6 months since my last post and a lot of positive things have happened at the macro level. Inflation went from 6.0% in Feb 2023 to 3% in June 2023. The S&P 500 index rose 14%, FB up 121%, TSLA up 60%, MSFT up 39%, AAPL up 37%, GOOG up 36%, and AMZN up 31%. These are all significant gains and it makes me wonder if I should continue my long breaks in blogging to keep this streak going.

But I cannot not blog about my personal update tonight because I’ve reached another personal milestone. Are you ready? Standby.

Jul 28, 2023

[

](/blog/3-ways-i-might-make-money-in-2023)

Feb 4, 2023

money, fire, stocks, real estate

3 Ways I Might make money in 2023

Feb 4, 2023

money, fire, stocks, real estate

For many, 2022 was a disaster year. Especially for me. I was set back by $1.84 million–yikes! Many people believe we still haven’t hit bottom yet and even fewer people believe that we will recover to 2021 levels in 2023. My prediction is that SP 500 will continue to hover around 3800-4200, mortgage rates will continue to hover around 6%, residential real estate prices will drop, but tech stocks will boom. Based on those predictions there are 3 areas I want to put my money to earn a positive return in 2023. Are you ready? Standby.

Feb 4, 2023

Enjoyed this post?

Subscribe to get my latest posts on financial independence, investing, and the journey to FIRE delivered straight to your inbox.

More Posts

Trump Accounts: Free Money for Your Kids (And How to Maximize It)

5 Things I'm Focused On In 2026

Comments