Is this the end of the FIRE movement?

The main concepts of the FIRE movement started from a book called “Your Money or Your Life” in 1992. And in 2011 Mr. Money Mustache amplified those concepts by giving the average worker hope. That as long as they can increase their savings rate through frugality, they can one day live off of a “safe” withdrawal rate of 4%. It has since become popular amongst millennials and has branched into different flavors (e.g. lean FIRE, barista FIRE, fat FIRE). But for the first time in its short history, the FIRE movement is being challenged. Since 2011, the real estate market has been booming, exceeding its 2007 levels and the stock market has averaged a yearly return of 13.6% from 2011-2019. In other words, it has not been truly tested--until now.

COVID-19 is that ultimate test. In the following article, I’m going to outline the different ways the FIRE movement is getting challenged and how I’m doing against my FIRE number. Finally, scroll to the very bottom if you want to see a sneak peek of what I’ve been working on during the COVID-19 lock-in.

COVID-19 test

The pandemic has introduced an unprecedented combination of problems to everyone’s personal finances. They impact our cash-flow and value of our assets in the following ways:

-

(cash-flow) Extremely difficult to find a safe job for the foreseeable future

-

(cash-flow) Passive income from stock dividends and rental real estate are at risk in the short term

-

(assets) Selling real estate is difficult and takes even longer to close

-

(assets) Stock markets are down 16% from all-time highs (as of 5/5/20)

(adsbygoogle = window.adsbygoogle || []).push();

Problems with the current FIRE movement

-

(1) FIRE-ing without sufficient cash - the FIRE movement is big on passive income, not cash laying around. Many people who attained their wealth were able to do so, because they squeezed every penny into investments that make them money, not cash in a bank that gets devalued over time. As a result, not many FIREes have much cash on hand, but instead rely on their “multiple passive income streams” to pay the bills. And if they want to temporarily jump back into the job market for some cushion, they would find it tough in this environment. COVID-19 has put an additional 30+ million Americans out of work in the last 6 weeks; companies are freezing their hiring pipelines, reducing their employees’ pay, and even rescinding their summer internship offers. If you weren’t making money before COVID-19, then it is going to be even harder to make money during COVID-19.

-

(2) FIRE-ing with debt - if one does not have a 6-month emergency fund, that may be fine, unless they are also carrying a lot of debt. Most FIREes are heavy on rental real estate. It’s been the best asset class for the average American to get rich on because they can leverage 1:3. That is, for every $1 they put in, they get to borrow $3 (for rental real estate they must put down 25% instead of the traditional 20% for a primary residence). It’s very common for FIREes to talk about how many “doors” they have and that their tenants are paying for their mortgages and retired lifestyle. But the impact of having no cash and carrying debt is that when a COVID-19 happens, the only lifeline left is the PPP loans (if they qualify)--at the moment, it seems like a mess.

-

(3) FIRE-ing with a low net worth - the lean FIRE folks retire with $500K, $750K, or up to $1M in net worth and frugally live off of a tiny fraction of that. They usually move to cheaper countries so that the US dollar stretches further. Being retired with a low net worth becomes increasingly dangerous when the income-generating assets face headwinds. COVID-19 is impacting all asset classes, so it is likely that the lean FIRE folks would need to sell some of their already beaten up assets to cover their expenses. Or be forced to move back in with their parents. In my opinion, lean FIRE is overly focused on retiring early, and has lied to themselves about what it takes to truly be financially independent. But to each their own.

-

(4) FIREes focus on NOT running out of money - when asked “when can I retire early” the answer is usually anchored around hitting a safe withdrawal rate (aka SWR) of 4%. SWR is a percentage that you can safely withdraw from your nestegg each year and not run out of money. Imagine being 80 years old with a dwindling portfolio because when you FIREd at 35 years old you were modeling how to *not* run out of money. Now add to that image...a COVID-65. The FIRE movement completely disregards the growth of wealth after retirement and that’s the biggest flaw that I see. It is the most dangerous because if it becomes a problem, you’ll be too old to turn things around.

(adsbygoogle = window.adsbygoogle || []).push();

FIRE movement prediction

These problems will most likely change the way in which some folks approach FIRE. Particularly, I believe this will be the end of the lean FIRE movement (i.e. retiring early with less than $1 million), as we know it today. Having a low net worth and withdrawing 4% of the small nestegg is a recipe for disaster.

Am I still on track to FIRE in 2.5 years?

Luckily, I am still on track for my Q4 2022 early retirement. To be precise, I’m +$105,264.45 ahead of my FIRE schedule as of the writing of this article. With the volatile market ahead, I don’t put too much emphasis on the exact number. I’m focused on holding enough cash (~10%) so that I can make the right moves. If you’re new to my blog, check out what my FIRE number is here and why I think the actual safe withdrawal rate is 2%.

What am I working on during the COVID19 lockdown?

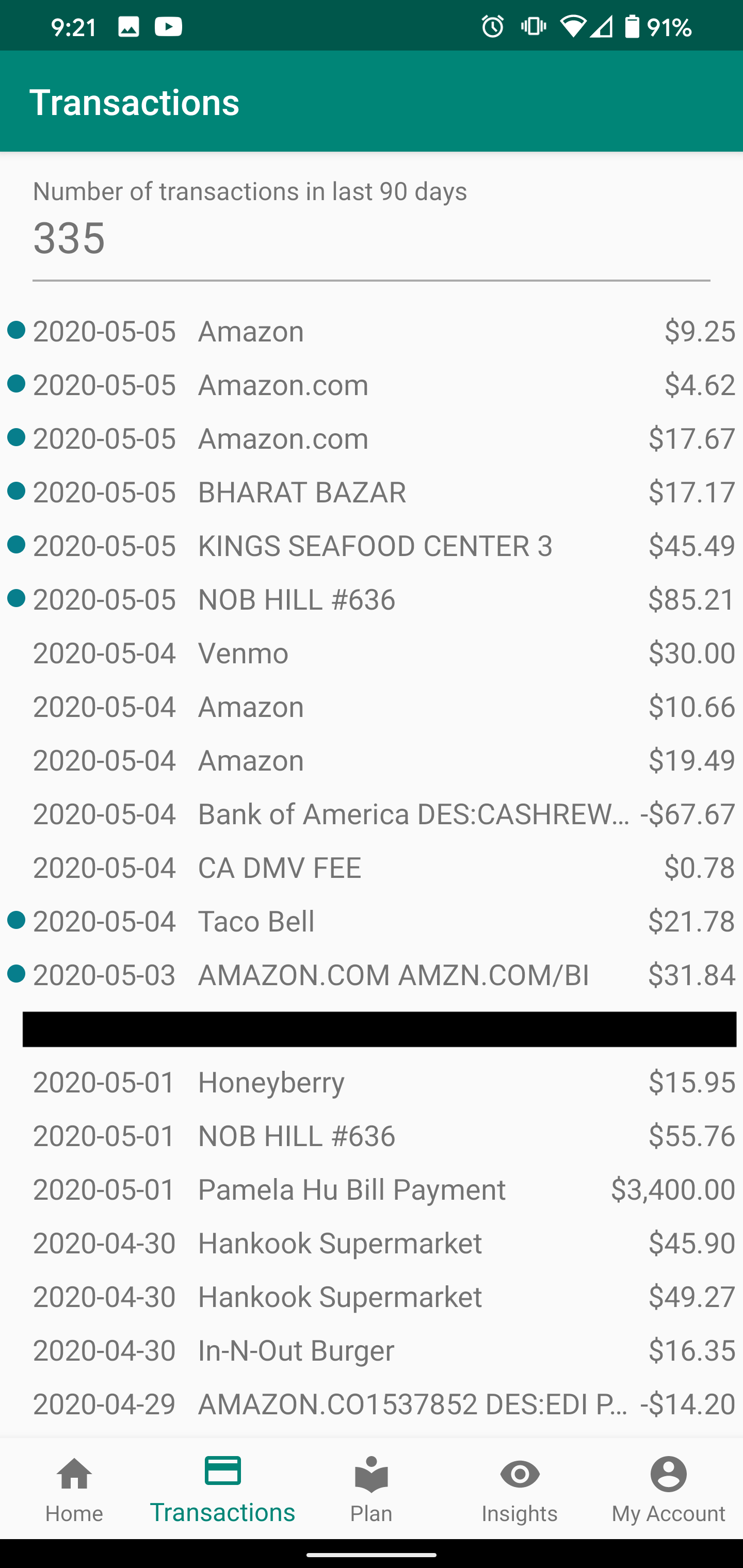

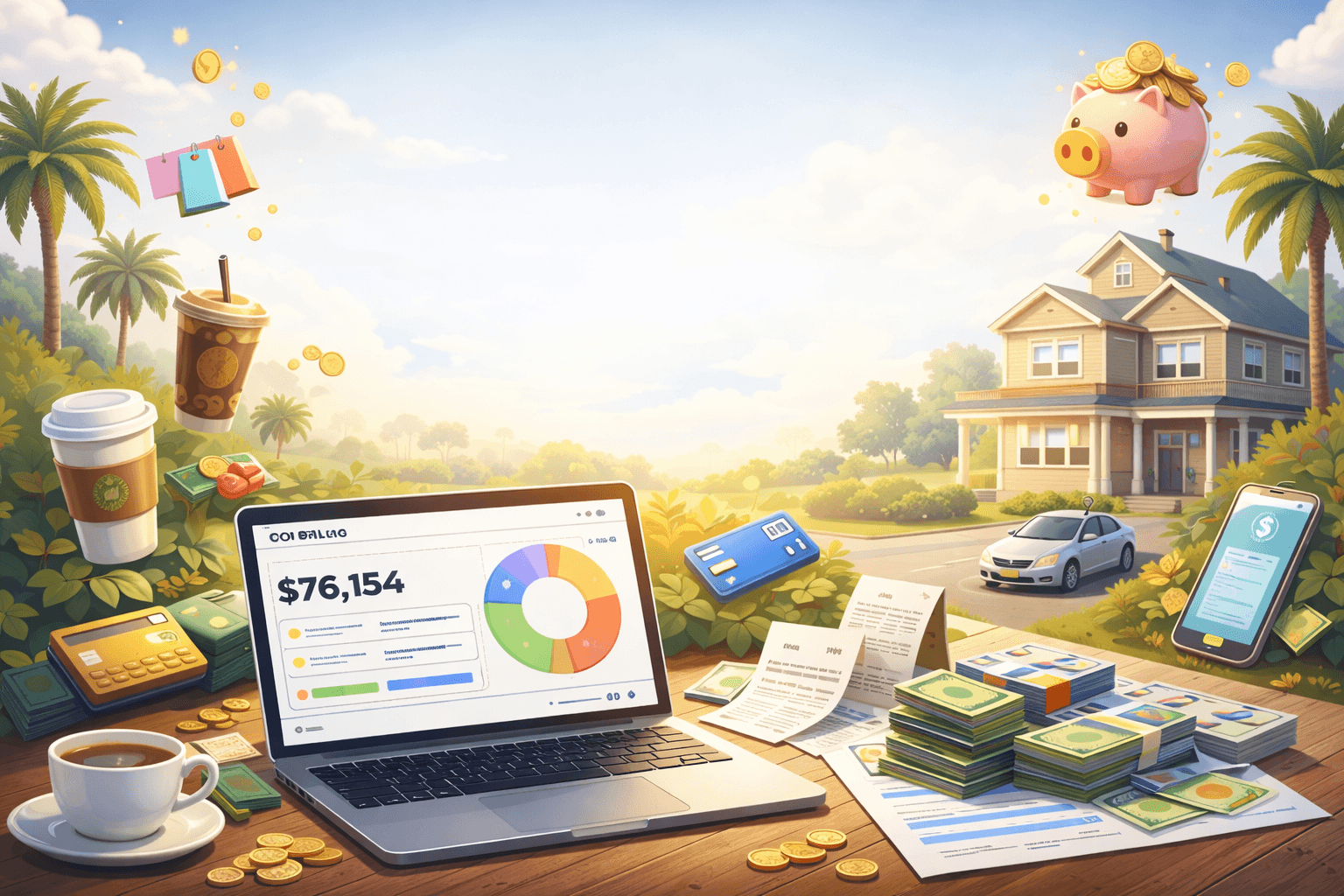

During this lockdown, I’ve decided to build a FIRE tool that will help guide the user to financial independence. I’m fed up with how slow Personal Capital and Mint are at refreshing my account info. The primary user of this app is myself :) and anyone else aiming to achieve financial freedom.

Introducing Figet (pronounced like “fidget”)

Here’s a sneak peek of what I have working:

NOTE: the numbers you see in my screenshot are real, but I have marked out the sensitive numbers to keep some level of privacy.

I’m not sure what the future holds for this app, but while I still have free time at home, I will continue to work on it and at least get it into production. If you want early access to my app, please subscribe and shoot me an email at vnguysoftware@gmail.com.

Featured

[

](/blog/im-building-a-fire-tool-and-i-need-your-input)

I’m Building a FIRE Tool — and I Need Your Input

[

](/blog/10-ways-to-succeed-as-an-employee-part-iii-of-iii)

10 ways to succeed as an employee (Part III of III)

[

](/blog/5-reasons-why-its-hard-to-retire-early-after-reaching-financial-independence)

5 reasons why it’s hard to retire early after reaching Financial Independence

[

](/blog/road-to-1000000-portfolio-series-part-1)

dividends, investing, portfolio, fire

Road to $1,000,000 portfolio (series) - Part 1

dividends, investing, portfolio, fire

dividends, investing, portfolio, fire

[

](/blog/my-77000-experiment-portfolio-year-end-2020-update)

dividends, portfolio, fire, stocks

My $77,000 experiment portfolio -- year end 2020 update

dividends, portfolio, fire, stocks

dividends, portfolio, fire, stocks

[

](/blog/road-to-10-million-retire-by-35-and-become-a-deca-millionaire-by-50)

Road to $10 million - Retire by 35 and become a deca-millionaire by 50

[

](/blog/my-77000-experiment-portfolio-june-update)

fire, portfolio, stocks, covid19

My $77,000 experiment portfolio -- June update

fire, portfolio, stocks, covid19

fire, portfolio, stocks, covid19

[

](/blog/how-am-i-navigating-covid-19)

[

](/blog/average-net-worth-by-age)

[

](/blog/how-engineers-can-fire-in-15-years-and-have-4000000-in-net-worth)

fire, tech, engineering, silicon valley

How engineers can FIRE in 15 years and have $4,000,000 in net worth

fire, tech, engineering, silicon valley

fire, tech, engineering, silicon valley

(adsbygoogle = window.adsbygoogle || []).push();

Enjoyed this post?

Subscribe to get my latest posts on financial independence, investing, and the journey to FIRE delivered straight to your inbox.

More Posts

Trump Accounts: Free Money for Your Kids (And How to Maximize It)

5 Things I'm Focused On In 2026

Comments