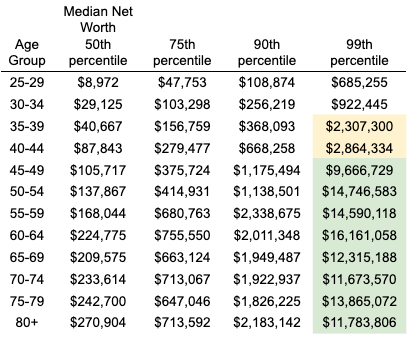

Average net worth by age

Did you know that the average net worth for people between the ages of 30 and 34 is $95,235.53? And that the median for the same age group is $29,125? That is, half of the people from ages 30 to 34 have more than $29,125 and the other half has less. In this article, we will explore net worth by age through a fat FIRE lens.

In 2016, the Federal Reserve conducted a Survey of Consumer Finances (SCF) to “understand the financial condition of families in the United States and to study the effects of changes in the economy.” I will be using this data to paint a picture of who realistically could fat FIRE if the world were to stop today. But I will caveat that financial mobility is still alive and well in America. People move up and down the ladder all the time. And by only reading the charts, you may take away a different perspective, so try to read my commentary as well.

Figure 1

In Figure 1, you’ll see that the median family will never be able to retire early. In fact, I would be pretty nervous if I were 64 years old and only had a net worth of $224,775, which includes my house. But things change a bit when you look at the top 25% and top 10% of families. Net worths in the high 6-figures, low 7-figures is a comfortable place to be, especially if you get to supplement that with a Social Security check.

The most interesting thing about Figure 1, from a FIRE lens, is that the difference in net worth between ages 40 and 50 is massive--$12M difference for the top 1%, $500K difference for the top 10%, $135K difference for the top 25%. It also happens to be the age at which most FIRE people plan to retire. Since we are foregoing our best earning years, it is even more important to plan properly. This is one of the reasons why I recommend a 2% safe withdrawal rate (SWR) so that the rest of the gains can be reinvested. Something to consider before stepping out of the workforce.

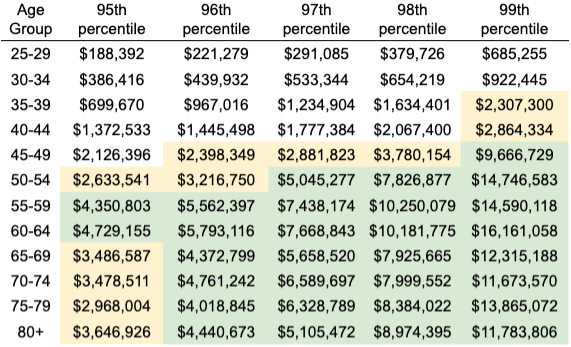

Figure 2

Figure 2 zooms in on the top 5% of families (95th percentile and up). Highlighted in yellow is the age group + net worth combination that would qualify as $2.3M+. Highlighted in green is the age group + net worth combination that would qualify as $4M+. I personally recommend $4M+ as a FIRE number, but since the FIRE movement is comfortable with $2.5M+, I’ve decided to highlight those as well.

For a family who is 55 years old looking to fat FIRE with $4M+ in net worth, they are in the top 5%

For a family who is 50 years old looking to fat FIRE with $4M+ in net worth, they are in the top 3%

For a family who is 45 years old looking to fat FIRE with $4M+ in net worth, they are in the top 2%

For a family who is 40 years old looking to fat FIRE with $4M+ in net worth, they are in the top 1.x%

NOTE: This data is from 2016. The net worth figures have undoubtedly gone up since then, due to the stock market appreciation. While there aren't more people in the top 1%, there are certainly more people who's net worth are above the $4M fat FIRE threshold now (2019), than there were in 2016.

Figure 3

Finally, Figure 3 shows that if you have more than $4M in 2016, then you are in the

top 1% if you're younger than 44 years old

top 2% if younger than 49

and top 6% if younger than 59

In conclusion, it looks like in order to fat FIRE you’ll have to be somewhere in the top 5% of wealthiest families in America to do so. As we become more financially literate as a country, I expect this number to change. But for now, the total addressable market (TAM) for my blog is 95% of Americans. Let’s go!