5 tips on how to use 529 plans

The cost of higher education has gotten expensive over the years. This means that being financially prepared for those 4+ years of college is more important than ever. As a parent of 1.5 kids (yes, one is in the oven), 529 plans have been top of mind for me especially during a market pullback such as now. In the following article I’ll share with you the reasons and best ways to utilize your 529 accounts. But first, what is a 529 plan? A 529 plan is essentially a brokerage account that is used specifically for education expenses. Anyone can deposit money into that account, and you can then purchase mutual funds that the plan offers. The gains that are made in that account can be spent tax-free. It is similar to 401k plans, used for retirement, or HSA accounts, used for medical care.

Tip #1 -- Front-load up to $150,000 in contributions

Since most of the readers of this blog are high-income earners, this tip is most applicable to you. You are allowed to front-load 5 years’ worth of gifts into a 529 plan. Since the maximum gift amount is $15,000/year, you are able to contribute up to $75,000 in the same year. The catch is that you will not be able to contribute any more for the next 5 years--hence, it is called front-loading. Finally, if you’re in a two-parent household, then your spouse can do the same thing. That is, each parent can contribute $75,000, totaling $150,000! If you do this early enough, I imagine your children will never need to worry about higher education costs!

(adsbygoogle = window.adsbygoogle || []).push();

Tip #2 -- Maximize the time the money is invested, especially if you have multiple kids.

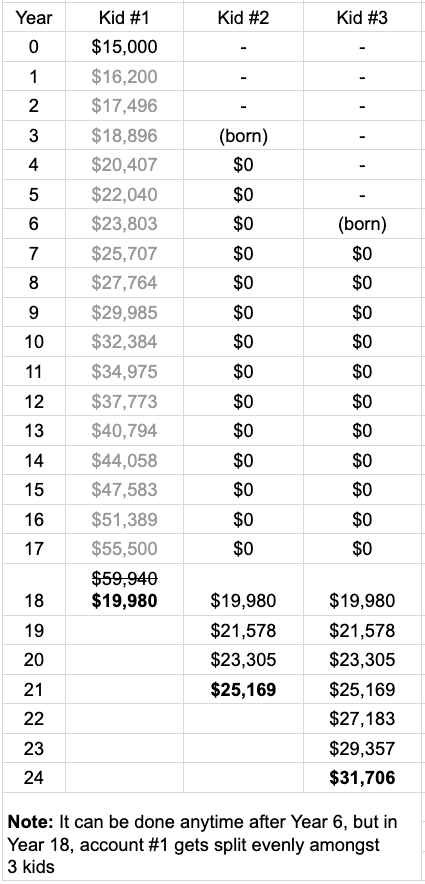

The great thing about 529 plans is that you are able to split the account into 2 to fund another account or you can transfer the beneficiary of the account to someone else completely. Combine that concept with the power of compounding and it gives the parent an extra optimization lever, which is extra time.

For example, if you have 3 kids, each born 3 years apart, then you would do the following to maximize the time for compounding for the 2nd and 3rd kids:

-

Fund the 1st kid’s account as if you had 3 children. Do this even before the 2nd and 3rd kids are born.

-

Once all 3 children are born, you can split that main account into 3 accounts and let them independently compound

-

The net impact of this strategy is that Kid #2 gets an additional 3 years to compound and Kid #3 gets an additional 6 years to compound! So for those who have the means to contribute early and plan to have multiple kids, this method will greatly benefit the youngest ones.

Here’s a chart that better illustrates what I mean, assuming an 8% rate of return:

Tip #3 -- Contribute to the 529 plan as early as possible

I opened my son’s 529 account 3 months after he was born. I would have opened it the day he was born if I weren’t too busy changing diapers and rocking him to sleep. Immediately, I contributed $3,000 per month for 5 months. In his first year, I contributed a total of $15,000. Assuming that the investments yield an 8% return over the next 20 years, the initial $15,000 will grow to be $69,914! Just like you should invest in your retirement as early as possible, the same concept applies to 529. However, please beware of investing in your children’s education that is beyond your means. That leads me to my next point.

Tip #4 -- Max your retirement before funding your children’s 529

I’ve seen a lot of people wanting to be “good” parents by funding their children’s 529 plan when they haven’t maxed out or even contributed to their own retirement yet. There’s a reason why the flight attendants tell us to put on our own mask before putting on the masks of our children. In order to maximize the total success, we need to prioritize our future so that we won’t be a burden on our children in our later years. Higher education is important, but not more important than our retirement. There are many options for a young person: work, study at a cheaper school, work and study, delay school until later, and scholarships. But oftentimes, the only option for a senior is to rely on others.

By extension, this also applies to all consumer debt. Don’t borrow money to contribute to your children’s 529!

(adsbygoogle = window.adsbygoogle || []).push();

Tip #5 -- Pick a state with good funds

I picked Nevada to open a 529 plan with. One of the common questions people ask is do I need to open an account with the state that I live in? Or do I need to open an account in the state that my kid will go to school? No. You can open an account with any state--there will be no restrictions on where you can live or where your kids have to go to school. States like Nevada or New York have better funds than other states because they have superior mutual funds to choose from. To know if a fund is good or not, you need to look at their performance and their expense ratio. The performance over the last 10-15 years will tell you roughly how good they are and the expense ratio will tell you the percentage you need to pay them each year for holding on to that mutual fund. I picked a fund that mirrors the S&P 500 index.

For what it’s worth, I rank the importance of 529 plans pretty low on my list of accounts to fund. That’s because I fully expect my children to get significant scholarship awards and work during their college years.

Featured

[

](/blog/the-post-financial-independence-life-no-one-talks-about)

The Post-Financial Independence Life No One Talks About

[

](/blog/im-building-a-fire-tool-and-i-need-your-input)

I’m Building a FIRE Tool — and I Need Your Input

[

](/blog/management-vs-ic-the-fire-twist-i-didnt-expect)

Management vs IC: The FIRE Twist I Didn’t Expect

2024 Year in Review - Top 6 highlights

[

](/blog/3-things-that-make-fire-hard)

investing, fire, money, retirement

investing, fire, money, retirement

investing, fire, money, retirement

[

](/blog/2023-year-in-review-top-6-highlights)

2023 year in review - top 6 highlights

[

](/blog/5-tips-on-how-to-get-promoted-in-a-big-company)

5 Tips on how to get promoted in a big company

[

](/blog/is-4000000-still-a-good-fire-number)

Is $4,000,000 still a good FIRE number?

[

](/blog/stock-market-is-back-to-near-all-time-highs)

Stock market is back to near all-time highs

[

](/blog/3-ways-i-might-make-money-in-2023)

money, fire, stocks, real estate

3 Ways I Might make money in 2023

money, fire, stocks, real estate

More Posts

Navigating Your Career in the Age of AI

The Post-Financial Independence Life No One Talks About

Comments