How much did I spend in 2020???

It’s that time of the year! I’m in the middle of writing annual performance reviews for my day job. And like all of the other managers, I needed a break from politicking. So I decided to spend a couple of hours reviewing my 2020 spending! Since I had a ton of fun doing it last year I thought I’d do it again. What a year! Standby.

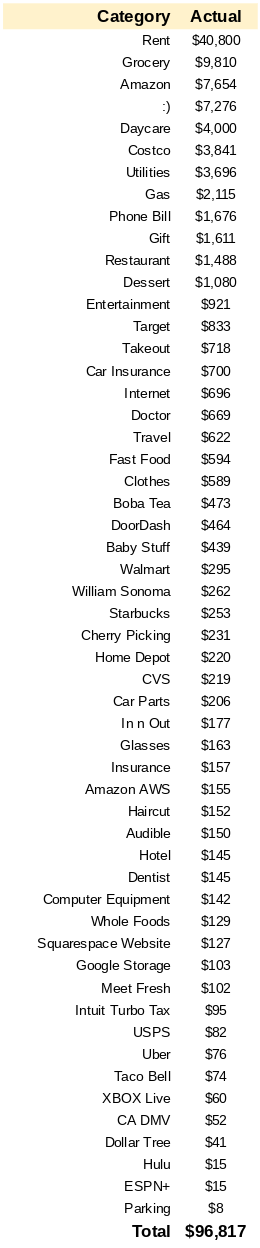

I spent $96,817 in 2020, which is the most I’ve ever spent in a single year (if car purchases aren’t included).

Transactions grouped by category

Distribution of Transactions:

-

1056 total transactions

-

2.7% (28) of transactions were $500+

-

11% (116) of transactions were between $100-$500

-

86.4% (912) of transactions were less than $100

(adsbygoogle = window.adsbygoogle || []).push();

Distribution of Transaction Value:

-

Transactions above $500 accounted for $54,946.56 (56.75%)

-

Transactions between $100-$500 accounted for $21,330.42 (22%)

-

Transactions less than $100 accounted for $20547.62 (21.2%)

Fun facts:

-

1056 transactions for 2020 = 2.89 transactions per day

-

We spent $15,120 on eating! This includes groceries, restaurants, DoorDash, fast-food, dessert, coffee, boba tea, etc. This explains the 10 pounds I gained during the pandemic...

-

The grocery bill coming out to be $9,810 seems really expensive, but we did a fair amount of cooking during the pandemic. Especially when you consider that I don’t get free food anymore :(

-

I said this last year too, but “Entertainment” is not much of a thing for my family. Based on this summary, it looks like eating is our entertainment.

-

With California (and our daycare) being shut down for most of the year, it made sense that our expenses leaned heavy on eating, utilities, Costco, and Amazon. Even though we were able to save from a significant decrease in daycare costs, we spent significantly more on the ones I just mentioned.

-

In light of the chaos happening around the world, I also picked up a new activity which is :). I won’t be revealing what it is at the moment...maybe one day. I consider it money well spent and may need budgeting for in the future.

How does this compare to my budget at the beginning of the year?

I previously posted how I budget as an engineer and a family of 3 living in Silicon Valley. TL;DR is that I look at the big categories, estimate how much I need, and automate the rest of the money out of my checking account so that I wouldn’t be able to spend it. For most of the year, we were a family of 3 so we budgeted $104,500. Given that we ended up spending $96,817, that means we under-spent by $7,683!

(adsbygoogle = window.adsbygoogle || []).push();

Where I did poorly

Utilities ($3,696) - We spent $3,696 on utilities last year. This is a lot considering that our place is only 1,100 sqft and has most of the modern energy-efficient appliances. I think this was due to us being at home more. It’s not great, but in the grand scheme of things, I wouldn’t have changed our habits to save here.

Dessert ($1,080) + Boba Tea ($473) + Starbucks ($253) - because we’re constantly stuck at home with a 2-year-old boy who cannot sit still, we usually go outside 5x times per week. This is a lot more than the 2x times per week in previous years. And like the last line item, I think this is not terrible given that we went out so many times. And in case you’re wondering, the boba tea spending is mostly my wife at a new place called Tan Cha--5 stars!

Cherrypicking ($231) - We spent $231 for almost 40 lbs of cherries! During the cherry-picking season, I took my family out to pick cherries at a local farm. We got a little carried away and ended up yanking cherries, stems, and even leaves off the trees. We walked away with 6 bags and 40 lbs of cherries. They were good--not $231 good though. We ended up giving away most of it to family and friends.

Where I did well

Sadly, I don’t think I did particularly well in any of the big categories. The reduction in daycare expenses and travel was by circumstance, not by choice. 2020 was not a good year for expenses for us--I imagine it wasn’t great for most people out there. However, it was by far the best year in terms of net worth gains for us. And I would attribute that mainly to having accumulated assets that go up and down with what the Federal Reserve wants to do.

Anyway, I’ll talk more about that and how I believe that is the primary cause of wealth inequality in a later post, but that’s beyond the scope of this one.

Conclusion

Overall, I’m satisfied with how the year went. I budgeted for a very generous $104,570 and ended up spending $96,817. We never felt like we were overspending, or even close to it because our checking account never dropped below my threshold for “danger.” I’m glad that the movement of my money is automated and that I don’t need to worry about having a strict budget. All I need to worry about is not running out of money in my checking account!

Featured

[

](/blog/the-post-financial-independence-life-no-one-talks-about)

The Post-Financial Independence Life No One Talks About

[

](/blog/im-building-a-fire-tool-and-i-need-your-input)

I’m Building a FIRE Tool — and I Need Your Input

[

](/blog/management-vs-ic-the-fire-twist-i-didnt-expect)

Management vs IC: The FIRE Twist I Didn’t Expect

2024 Year in Review - Top 6 highlights

[

](/blog/3-things-that-make-fire-hard)

investing, fire, money, retirement

investing, fire, money, retirement

investing, fire, money, retirement

[

](/blog/2023-year-in-review-top-6-highlights)

2023 year in review - top 6 highlights

[

](/blog/5-tips-on-how-to-get-promoted-in-a-big-company)

5 Tips on how to get promoted in a big company

[

](/blog/is-4000000-still-a-good-fire-number)

Is $4,000,000 still a good FIRE number?

[

](/blog/stock-market-is-back-to-near-all-time-highs)

Stock market is back to near all-time highs

[

](/blog/3-ways-i-might-make-money-in-2023)

money, fire, stocks, real estate

3 Ways I Might make money in 2023

money, fire, stocks, real estate

Enjoyed this post?

Subscribe to get my latest posts on financial independence, investing, and the journey to FIRE delivered straight to your inbox.

More Posts

Trump Accounts: Free Money for Your Kids (And How to Maximize It)

5 Things I'm Focused On In 2026

Comments